An overview of the industry performance and factors driving M&A activity

The mining industry has always been a cornerstone of the Australian economy, responsible for up to 75% of the country’s exports, the direct employment of over 140 thousand people, and many more indirectly. Despite the closure of mines in South Africa and Chile due to the COVID-19 pandemic, the Australian mines have managed to keep on running with a comparatively low rate of infection compared to their international rivals.

Australian mining services recovered in Financial Year 2021 (FY21), boosted by strong industry fundamentals and a keen willingness by clients to sustain and increase operations. We are also seeing increased support from the equity markets for several new mining projects and exploration programs providing an uptick for mining services.

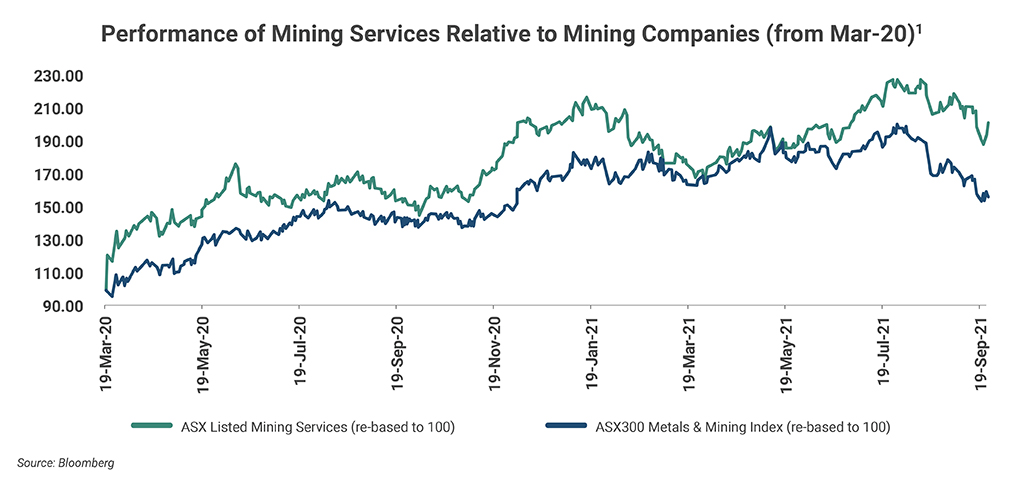

Mining services companies have offered enhanced returns when compared to the performance of the ASX 300 Metals and Mining Index since March 2020 when the COVID-19 pandemic began as displayed in the chart below.

In this article, we look at how the Australian mining industry is faring and examine the cascading factors driving M&A activity within the mining services industry.

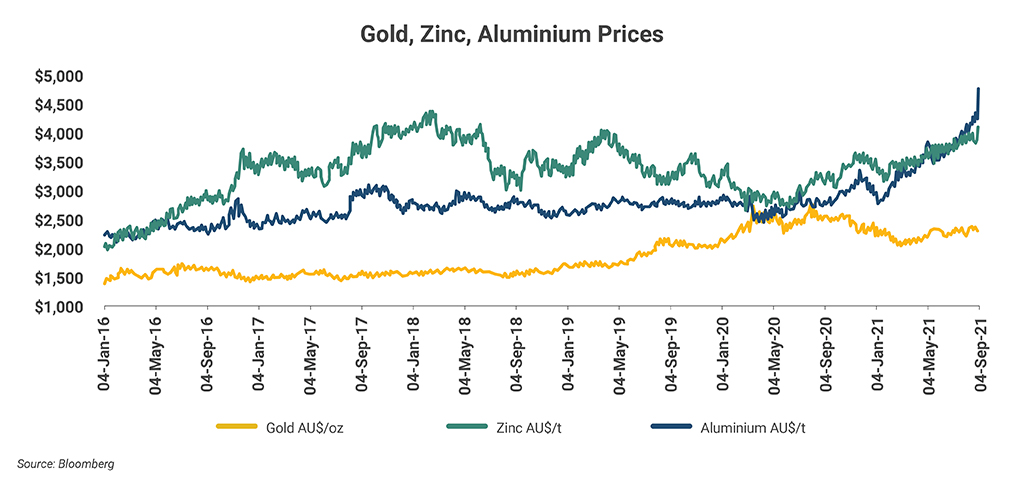

Strong Commodity Price Performance

- Global economic recovery from COVID-19 pandemic lockdowns has triggered extremely high prices for most mineral and energy commodities. Some of the factors leading to higher demand for mining services are:

- Global shortages triggered by supply disruptions and ongoing global trade restrictions for coking coal have also seen its price triple which are expected to drive mining activity

- Gold’s higher pricing over the past two years has seen a flurry of exploration activity

- The exit from thermal coal announced by the majors as the economy transitions to clean energy

- High government infrastructure spending is anticipated to stimulate economic recovery.

- Clean energy transition is reliant on several key metals and minerals which in turn is accelerating mining activities of those commodities. For instance, demand for lithium, rare earth, and other critical metals are needed for electric vehicles and battery storage exceed current production rates.

- Increase in orderbooks showing 1x - 3x times current revenue from FY20 to FY21 [2] demonstrating strong demand for mining services. There is a high likelihood of a sustained increase in mining activity stemming from increased exploration, new projects and production extension which will continue to drive demand for mining services. These factors are expected to bode well for contract pricing, tendering, and scope increases.

Recovery on the Way but COVID-19 Impacting Margins

Australian mining services recovered in FY21, boosted by increased numbers of new projects and exploration programs off the back of increased activity levels within capital markets. In most jurisdictions, mining operations are considered essential to economic recovery and are exempt from hard lockdowns. However, the pace of growth was tempered due to:

- labor shortages due to a buoyant industry – ability to deliver contracts dependent on having access to the right people whilst mitigating the inability to source the required labor due to travel restrictions

- wage inflation – unprecedented competition leading to increased staff turnover, causing companies to pay higher wages to mitigate against lower productivity due to skill shortages

- supply chain pressures – shipping time on key routes have more than doubled increasing procurement lead time for equipment and freight charges

- companies are relocating workers, undertaking various initiatives to retain people including salary benchmarking, flexible rosters, incentive payments, investment in leadership and assistance programs. Preference is being shown for contractors who have existing fleet capacity given the delays in supply times from the equipment manufacturers.

Using Technology to Improve Productivity

With new discoveries most likely to be underground due to declining discoveries of high-quality accessible ores, there is an increasing demand for technologies that:

- enable remote mine operations;

- identify technical and economical solutions for new developments;

- extend existing mine life and optimize recoveries; and

- rehabilitate late-life assets in commodities which have fallen out of flavor due to the clean energy transition.

An increasing number of mining majors such as BHP, Rio Tinto, and Glencore are leveraging technologies to improve productivity and optimize mine safety. Technologies with the potential to deliver significant benefits include:

- Autonomous haulage vehicles with a GPS, obstacle detection system and vehicle controllers which improve mine safety, lower operating costs, and reduce wear and tear;

- 3D laser scanning technology for precision mapping of shape, position and location of objects;

- Automated drilling and blasting technology which boosts productivity and ensures safety;

- Drones or Unmanned Aerial Systems (UAS) making headway to perform operational tasks;

- Digitalization and mining software for compiling, sorting and storing data for easy access, even remotely;

- Smart data and machine learning to improve operational efficiency, safety, production workflow; and

- Artificial intelligence that generates day-to-day data faster.

Conclusion

The overall outlook for the mining services industry is positive, but the pace of recovery will be measured given supply chain bottlenecks including labor and equipment availability. We are in the early phase of mining activity as exploration levels are still below prior peaks, which should provide a strong revenue environment across the mining services sector for the next few years.

Companies are expected to turn their attention to:

- Organic and M&A growth to realize operational synergies by focusing on scale and recurring revenue streams (refer to the timeline below for sector M&A activity over the past financial year)

- Emphasis on revenue diversification to minimize earnings volatility by adapting exposure to key global commodities and niche market or service offerings that will continue to perform well in the coming years.

Companies who are unable to offset higher costs and/or invest in retaining employees, equipment and technology to improve productivity may see an increase in underperformance and their risk profile. Given the Australian mining services industry is highly concentrated with high barriers to entry, there is likely to be opportunities for smaller players to explore exit strategies to optimize value in the current landscape.

Key Transactions within Mining Technologies

Indra Ruthramoorthy and Surya Alapati contributed to this article

© Copyright 2021. The views expressed herein are those of the author(s) and not necessarily the views of Ankura Consulting Group, LLC., its management, its subsidiaries, its affiliates, or its other professionals.

[1] The ASX listed Mining Services (re-based to 100) is based on Ankura analysis

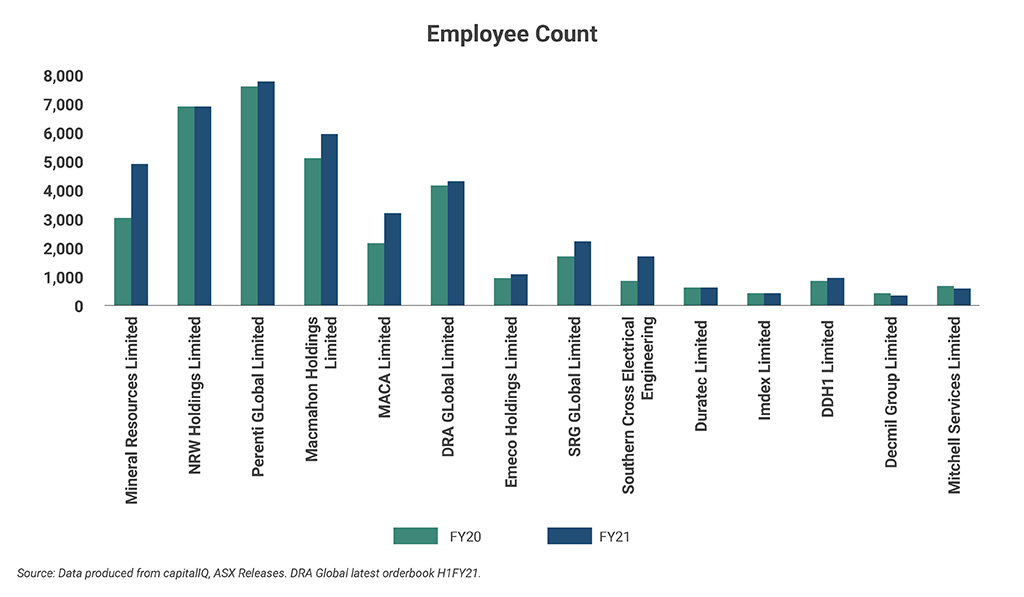

[2] Data procured from CapitalIQ, ASX Releases. DRA Global latest orderbook H1FY21.