Credit Reserves: Are They Adequate?

For many regional and community banks, the preparations for both CECL and COVID-19 have significantly lagged larger banks during 2020.

While that’s not news to some, it may portend a disconcerting few months for community and regional banks. September 2020 statistics show community and regional banks are behind their big-bank counterparts in setting aside provisions for loan loss reserves, or Allowances for Credit Loss (ACL), following the onset of COVID-19.

This may be supportable due to differences in industry exposure, types of credit extended, and size of exposures. However, it is important to have thought through these issues ahead of time and developed the diligence support to defend your position with your audit firm and regulators.

Our view is that bankers must be lightning quick in focusing on potential issues now – including upgrading loan review procedures and carefully validating CECL drivers.

How Did We Get Here?

Banks have found very accommodating regulators during the current recession. Consider that:

- CECL implementation has been deferred for most community and regional banks by one to two years;

- PPP and loan payment deferrals may have deferred some borrowers’ operational issues from fully surfacing;

- Submitting financial statements may be the last thing on borrowers’ minds as they have addressed pandemic-related issues.

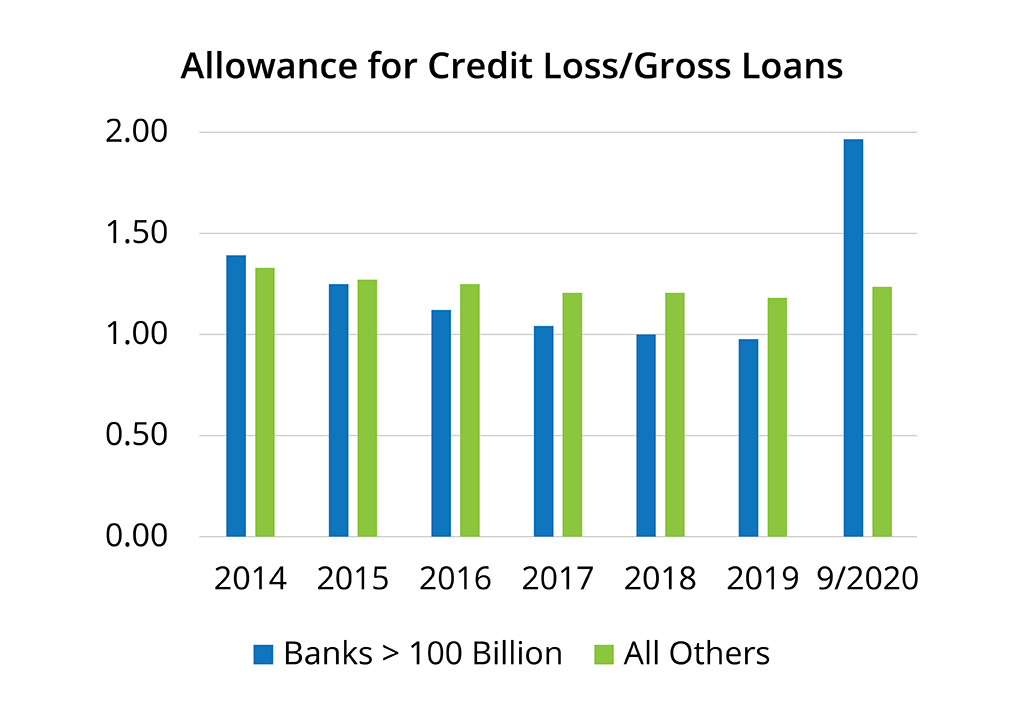

Both large and small banks had similar amounts of ACL as a percentage of gross loans before CECL. However, while community and regional banks have remained at a median of about ACL of 1.20 percent of gross loans, the largest banks bolstered ACL to a median of 2.00 percent of gross loans on September 30, 2020, as shown below.

Admittedly, larger banks have had historically greater net charge-offs, as the following table illustrates.

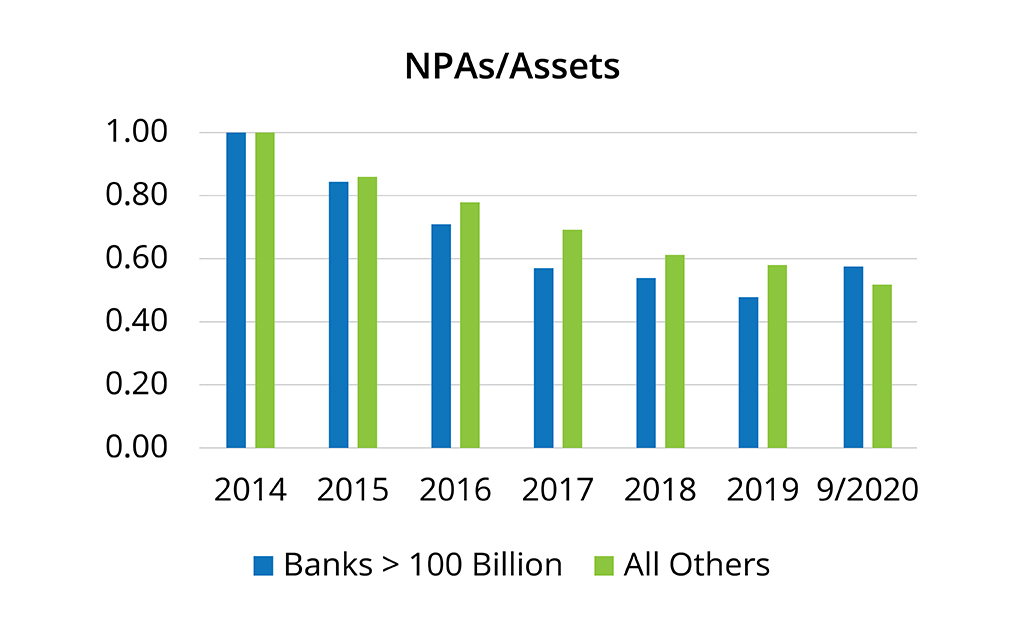

As a final measure, in recent years the median nonperforming assets as a percentage of all assets have changed only modestly across the industry, as the table below shows.

Our view is that, among large banks, trends show CECL is doing what it was designed to do: bolster ACLs during times of credit stress. Among smaller non-adopter banks, trends suggest a lag between problems and increasing allowances, which is indicative using an incurred loss methodology for building an ACL. If there is adequate support for a comparatively low ACL, your bank needs to be armed with the answers.

Action Steps

While charge-off history suggests ACLs might justifiably be smaller at community and regional banks, it still must be asked whether enough provisions have been set aside to weather the storm. Good preparation entails several steps:

- Upgrade Loan Review – Take a hard look at your objectives in performing loan reviews. Review stresses and take a close look at collateral value in today’s environment. Ensure that every borrower with PPP or deferrals is reviewed carefully and fully.

- CECL – Double check your loss drivers and economic environment. Make sure that whatever your model says matches what is truly in your portfolio. This is especially critical if your bank is using peer data as a significant input into your CECL model.

- Credit Administration – Don’t overlook credit administration practices and procedures. Make sure you are getting timely financial data from borrowers. Also, be alert to concentration and exposure risk. Other parts of your credit policy also may need review in the current environment.

Ankura Assistance

Ankura is a full-service financial services consulting firm with senior staff whose experience in advising banks goes back to the savings institution crisis of the 1980s. Our team includes economists, MBAs, investment bankers, former chief financial and operating officers, loan administrators, and credit specialists.

Our senior staff collaborates closely with our clients to optimize solutions, identify risk, and value both opportunity and exposure.

Our Services

Ankura’s core banking services include:

- Risk Management, including model risk management, credit review, and credit risk assessments, CECL support, and other high-risk model validation, documentation, and testing.

- Valuation, including M&A valuation support and impairment testing.

- M&A Advisory, including due diligence, integration, and accounting support.

- Real Estate Consulting, including valuation and strategy support for financial institutions.

- Strategic Advisory, including branch profitability tools, branch system reviews, branch sales, and development.

- Fairness Opinions for acquisitions, divestitures, sales, and support.

© Copyright 2021. The views expressed herein are those of the author(s) and not necessarily the views of Ankura Consulting Group, LLC., its management, its subsidiaries, its affiliates, or its other professionals. Ankura is not a law firm and cannot provide legal advice.