When world events plunge us into an economic downturn, many companies, as a matter of survival, must squeeze every non-essential cost out of business operations, as quickly as possible. This condition is particularly difficult in the “talent-first economy”, where total workforce investment typically is a company’s first or second largest operating expense. Applying a “clean page”, value-driven approach to strategic workforce composition and deployment represents one of the greatest cost-saving levers available to senior leadership. However, the lessons of the past remind us that this tactic must both drive value and balance core values.

Value + Values

Executives invest a significant level of capital and attention to select, develop, and retain a talented and engaged workforce – the “greatest asset”. Now is not the time to rashly alter these commitments with subjective and reactive approaches to workforce reduction. Reducing strategic capabilities and diluting high-performance cultures while downsizing workforce expenses is a common error. Done correctly, businesses can aggressively respond to short-term imperatives while preserving the soul of their company.

As fiduciaries of the companies we lead, we are sometimes afflicted by a strange mix of déjà vu and amnesia, where we forget what we thought we knew, all over again. After all, we have been pressed to dramatically reduce workforce expenses (i.e., downsize, right-size, rationalize) in the past. We should build upon our learning and, importantly, avoid the missteps that have such long-term consequences.

Hope Cycles Eternal, and Hope Creates Optionality

We know the economy is cyclical. Accordingly, we must consider the recovery even as we aggressively respond to weakness. This posture creates the potential for breakthrough thinking that will transform our commercial enterprises for the long-term. Leaders must be dedicated to making crucial decisions, including maintaining brand identity and corporate culture, that will determine the performance of the enterprise for decades to come. And, the “correctness” of these decisions won’t really be known until their consequences are upon us. The current crisis presents the opportunity to implement enduring capabilities and methodologies that enable greater competitive readiness, higher levels of employee commitment and activation, more magnetic company cultures, and better financial outcomes.

Human Equity Valuation™: Zero-Basing the Workforce for Strategy Execution & Value Creation

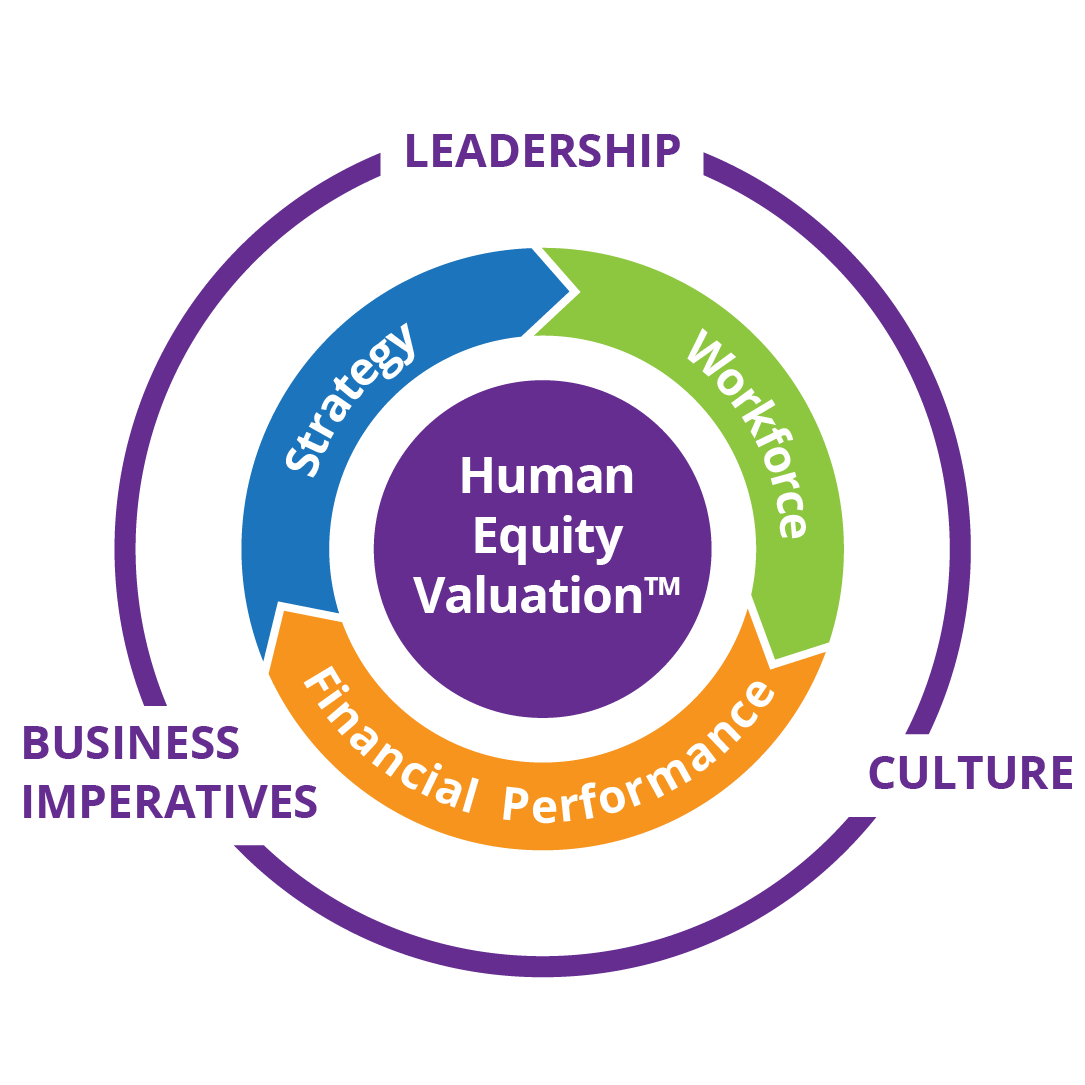

The HEV approach often produces impressive savings and liberates companies from defaulting to entrenched positions that are perpetuated by past spending trajectories and internal politics or retaining unproductive organizational units that do not justify their ROI. Novel reallocation of capital to higher-value roles focuses the organization – from top to bottom – on strategy execution and value creation.[1] HEV enables a business’ ability to make empirical, considered choices about total workforce spending. Further, HEV provides measures that signal when and where further attention is required.

HEV is a comprehensive approach that extends zero-based-budgeting principles to the totality of workforce investment spending. This approach has helped numerous companies reduce costs and jump-start growth, improve financial performance, and instill a culture of strategy execution and value creation.

Applying HEV to Aggressively Reduce Costs & Improve Long-Term Competitiveness in Recessionary Periods

When implemented for a division or throughout the enterprise, HEV promotes the leanest, fit-for-strategy workforce composition possible, and frees capital to be invested in strategic growth initiatives. Workforce productivity is monitored through greater transparency, revealed in period-over-period HEV Impact Statements, that enable leaders to track workforce productivity and redirect capital. Metaphorically, it is a “best offense is a great defense” game plan.

The payoff is well worth it. When HEV is implemented as the overarching philosophy to enhance competitive capabilities and promote a “dynamic”, high-performance culture, a company can achieve cost savings of 10 to 30 percent (depending on the size and complexity of the workforce) while allocating more capital to strategic priorities.

How HEV is Different from Traditional Cost-Cutting Methods

Companies have numerous levers to pull to reduce operational costs and most have already been pulled. Here, it is time to implement HEV and transcend traditional cost-cutting approaches. HEV distinguishes itself by acting as a platform to identify low-value-added employee roles – roles that create minimal value or even destroy value – thus enabling better choices. In simple terms, HEV combines greater visibility about workforce investment decisions, intelligent targets for spending and performance, and a philosophy that activates leaders to allocate the company’s workforce deployment resources in the best possible way. Examples of these alternative actions include: reengineering the scope and decision authority of high-value roles, the provision of productivity-enhancing technology, highly focused training, coaching, leader development and the realignment of incentives. HEV brings focus to workforce deployment in support of a company’s business strategy, including growth agendas, while creating a high-performance company culture.

HEV takes an inductive approach to the current state total workforce investment, drawn from existing financial statements, total reward plans, contracts and HRIS data. This effort often requires data integrity improvements to paint an accurate picture of workforce investment by role within both cost and profit centers. The goal is to quickly provide management with a single source of current workforce spending and associated financial yield, in a manner that informs scenario plans, alternative decisions, benchmarks, budgets, and targets.

The Heart of the Matter: What Cycles Down Will Cycle Up

As economic crisis causes many executive leadership teams to confront the reality of aggressive workforce cost reductions, how you do it is nearly as important as what you do. Anxieties are already running high, and your actions will reverberate for months or years for all those under your leadership. Your actions now become your policy and determine the company destiny. Your reputations are at stake. Your brands will be defined or redefined in accord with your actions. The morale, engagement and productivity of your workforce will be determined by your actions in this moment. Things will cycle back, as they always do, and your approach now will accelerate or decelerate your recovery. You have a greater range of choices at your disposal than you may be aware to radically reduce costs in concert withenhancing strategic capabilities and shaping a culture of performance for years to come.

As you contemplate your next move, it is important to note that layoffs do not create as much cost savings as commonly believed. According to Job Security Surveys conducted by SHRM, only thirty-two percent of the responding companies said that layoffs improved profits.[2] Even significant layoffs in large companies did not produce increased earnings years later. Similarly, another survey of the S&P 500 showed that profitability did not necessarily follow downsizing, even two years later.

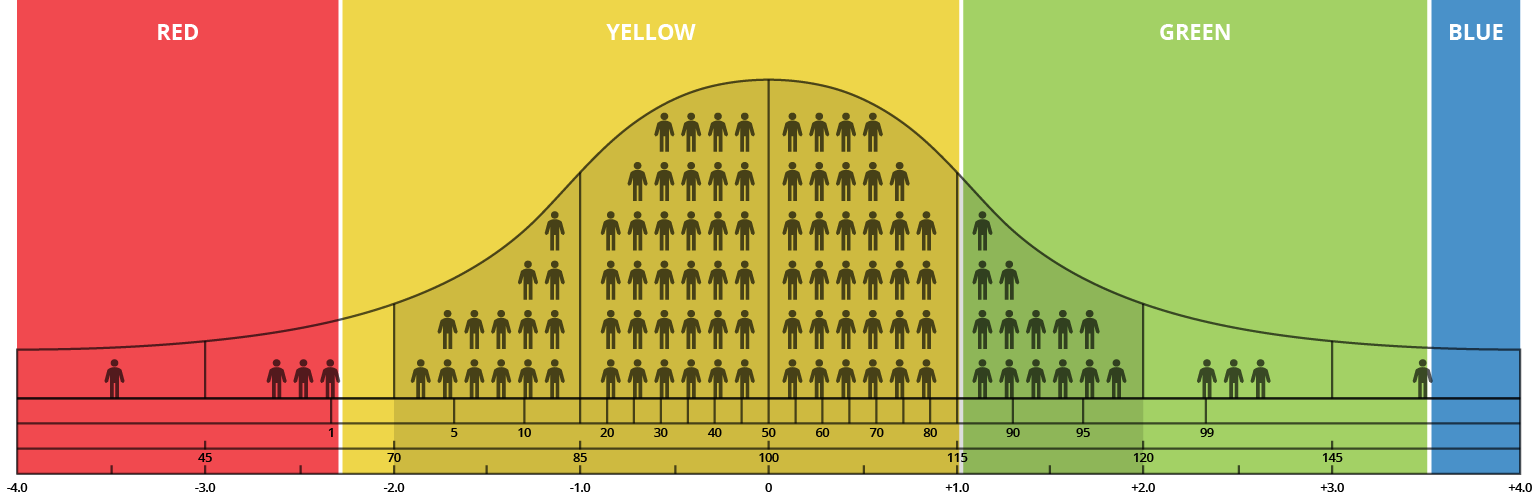

At an employee level, the real cost of turnover amounts conservatively to 50 percent to 75 percent of the departing hourly employee’s annual cash compensation and 150 percent to 300 percent of an exempt employee’s salary, depending on industry. This includes direct and indirect costs of sourcing, onboarding, and developing new employees and lost productivity and inefficiencies, which are 80 percent to 85 percent of the total.[3] By way of example, a company that lays off five salaried and five hourly employees, paid $150,000 and $50,000 respectively, will lose between $1,000,000 and $1,950,000 exclusive of legal liability and litigation costs.

Adversity that Unifies

HEV implementation reduces the total workforce investment and can create a sense of shared sacrifice to galvanize a committed, high-performance culture. We have found the following approaches, that may be employed separately or in combination, to be highly effective.

- Spans and Layers Restructuring – increasing managerial breadth while flattening the organizational hierarchy to reduce costs, and speed communication and decision-making.

- Rebalancing the Workforce – move people from strategically irrelevant or historically important roles to new roles that drive future value.

- Telework – working from an off-site location (often one’s home) increases productivity and job satisfaction while reducing capital and operating costs.

- Reduced Work Schedules – voluntary or mandatory reduction in work hours and corresponding salary that may include temporary reduction in benefits, such as 401k matching funds.

- Furloughs – voluntary or mandatory time off without pay taken as occasional days or in blocks of time.

- Sabbaticals – voluntary or mandatory unpaid or partially paid leaves of absence or time off, typically for a specified period of weeks or months.

- Personal Time Off (PTO) – compelling employees to take PTO which lowers long-term financial obligations and increases the probability that employees are available to work in the future, after the upward cycle begins.

- Pay Cuts – voluntary or mandatory pay reductions for some or all employees (often with more sizable contributions by exempt employees at the top of the company hierarchy).

These tactics are employed by companies who have come to be lauded as “resilient,” “enduring,” and “survivors”. By employing a variety of these responses, the companies have garnered the following benefits and advantages:

- Reduced legal liability and litigation costs (de-risking the restructure)

- Improved corporate brand reputation

- Lower direct workforce expenses

- Savings in severance and outplacement costs

- Maintained or increased productivity and employee engagement

- Retention of the highest-value, most scarce talent

- Corporate-wide sense of solidarity and shared sacrifice

- Improved employer brand, thus facilitating future talent acquisition initiatives

- Survival of the company and its ability to respond and recover, which is a win for all stakeholders – investors, suppliers, communities, customers, and employees

Michael Porter advocates, “[G]ood leaders need a positive agenda, not just an agenda for dealing with a crisis.” By employing HEV, our clients have an immediate action plan and an agenda for the future. We challenge companies to shape their legacies by putting courage into practice in the vital area of human capital management.

[1] Ankura employs Strategic Activity Mapping to explicitly connect market differentiation to company capabilities and company capabilities to employee competencies.

[2] Society for Human Resources Management

[3] Various studies, conducted by Society for Human Resources Management (SHRM), Center for American Progress, and LeadFirst Learning Systems, LLC.

© Copyright 2020. The views expressed herein are those of the author(s) and not necessarily the views of Ankura Consulting Group, LLC., its management, its subsidiaries, its affiliates, or its other professionals. Ankura is not a law firm and cannot provide legal advice.