Certificate of Need (CON) regulations are in flux in many states. Health systems must prepare to lose the market share protection that regulations have provided for decades. It is time to pivot to an offensive approach to claim patient preference.

The current Certificate of Need climate

As of 2021, 12 states have fully repealed their CON programs or allowed the program to expire. In 2022, Georgia, North Carolina, South Carolina, and West Virginia proposed legislation to repeal or overhaul their CON statutes.

Why now? Motivation to deregulate on both ends of the spectrum

On both sides of the aisle, politicians receive pressure to update Certificate of Need legislation. Despite differing motives, all proponents have a shared interest in increased access.

A gradual erosion of regulatory protections

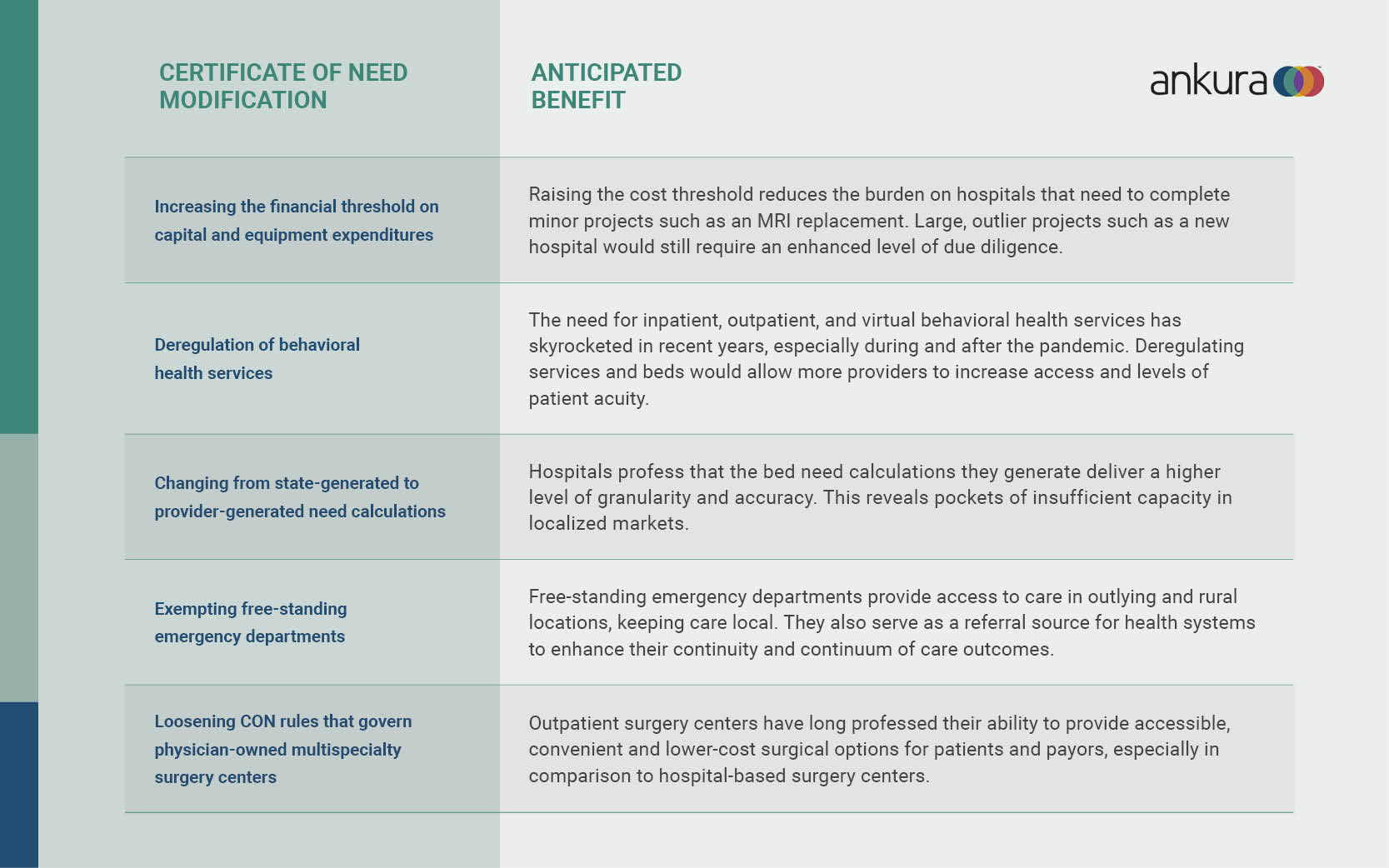

In some instances, it is more palatable to relax regulations in a piecemeal fashion rather than end them altogether. Most CON modifications seek to expand thresholds. This increases access while continuing to provide cost control oversight.

If your market share growth strategy is to win the CON approval game, look out

In the 35 remaining states with CON laws, hospital-centric providers’ primary market share growth strategy is to succeed at the CON approvals game. This approach has diminishing returns for several reasons. The effort of the application process, employing lobbyists, and litigating the outcome is inherently costly. It also incurs the significant opportunity cost of delayed revenue generation. Moreover, existing market share continues to erode outside the jurisdiction of CON through industry-wide trends and market disruptors.

Industry trends that threaten health system market share include:

- The shift of surgical volumes away from hospitals

- Private equity investments in urgent care centers, outpatient procedures, and long-term care capacity

- Emerging micro-hospitals in both urban and rural areas by third-party providers.

- Evolution of large, independent physician groups

- Self-insured, large employers such as Amazon and Lowes are engaging in the cost and outcomes of their covered lives. This drives referrals and hospital-based use rates.

- Non-traditional primary care providers such as CVS

- Rural healthcare gap fillers such as Dollar General

Moreover, healthcare has become more digital and centered around convenient access at home and on the go. New competitors offer touchpoints that do not require CON approval. These touchpoints require less capital and are less facility-focused.

Non-traditional new players in the market include:

- Virtual health companies

- Payors becoming providers

- Hospital at Home providers

- Tech start-up with app monitoring

- Capitation-based payor/providers who manage the patient relationship

The combination of diminishing CON competitor protection, industry trends, and non-traditional new players means that health systems need a new strategy for growing their market share.

What we learn about market share from states with fully repealed CON regulations

Three years after the 2019 Florida CON repeal, the impacts of deregulation in a high-growth state are emerging. Incumbent providers expand their geographic footprint to increase health system market share in an “arms race”. For instance, as of January 2022, Advent Health had 13 construction projects underway from Flagler to Polk County.

Out-of-state brand specialists such as Cleveland Clinic, Mayo Clinic, and Dana Farber have also entered the market with new joint ventures, hospitals, and branded specialty centers. Other industry disruptors like Optum are creating new forms of competition by acquiring primary care clinics to sub-specialty providers nationally. Optum then refers patients either to these newly acquired sites or to digital sites of care that are often unregulated and less costly.

Five techniques to claim health system market share in an increasingly competitive environment: (see the printable checklist)

- Use Market Data and Current Capacity Analyses to Identify and Justify Future Needs.

Look for data-driven, unique differentiators in your market that are high growth or under-served. Use these opportunities to support market-based future services and business development.

- Understand your true Costs per Patient Day or Encounter to assist cost reduction efforts.

This is vital in the industry’s movement towards value-based care and an interim step to negotiating better payor contracts.

- Look for ways to balance mission-based services with profitable service lines.

A balanced portfolio of markets, constituents, and service offerings delivers access, equity, and financial performance.

- Identify and execute a “second engine” for long-term financial viability.

Traditional health systems must find better methods to reduce costs and improve the patient experience. They must create additional sources of revenue that fall outside historical operations. It is time to play offense.

- Partner with non-traditional providers along the care continuum.

Health systems have developed business models that require them to be everything to everyone 24/7. This requires significant capital and infrastructure in an economy that is highly segregated and individualized based on value. Creating a partnership model to service patients along their individual care journey allows for cost reduction, specialization of care, and better value. A partnership model lets health systems compete more effectively and win!

Conclusion

The CON definition of healthcare has not yet extended to many disruptors. Until changes are made, your business could continue to be impacted and you may need to incorporate new strategic tools to remain a market leader. Let us help you get ready!

Next Up: Due to a number of political and societal issues, we believe the drumbeat around CON legislation could extend beyond state regulation to the question of tax-exempt public benefit. Do you agree? We’ll explore this more in a future post.

Ankura Healthcare Real Estate Solutions

At Ankura, we want to position you to lead transformation in healthcare. We help healthcare providers, like you, revolutionize how you plan for capital distribution to achieve higher ROIs while improving healthcare for your communities and families.

Our comprehensive services in strategy, facilities, and capital solutions maximize the operational and financial performance of your real estate portfolios and capital investments. We advise, manage, and execute strategies that mitigate the risks inherent in deploying capital projects. The result is the right care, in the right place, at the right time, for the right patient, and at the right price. Learn more

© Copyright 2022. The views expressed herein are those of the author(s) and not necessarily the views of Ankura Consulting Group, LLC., its management, its subsidiaries, its affiliates, or its other professionals. Ankura is not a law firm and cannot provide legal advice.