2022 was an eventful and tumultuous year that will long be remembered for aggressive Fed tightening, the Russia and Ukraine conflict, the cryptocurrency meltdown, and a sharp reduction in IPO and SPAC activity. 2023 is expected to be no less volatile. So how are finance executives thinking about next year? We recently surveyed finance executives for their perspectives on a variety of topics ranging from the state of the economy to their role as a CFO and the evolving finance organization. The responses provide a glimpse into the changing demands on public and private CFOs and their priorities for this year.

To no surprise, our survey revealed that the role of a CFO is already one of the hardest jobs in corporate America, and it’s only getting harder.

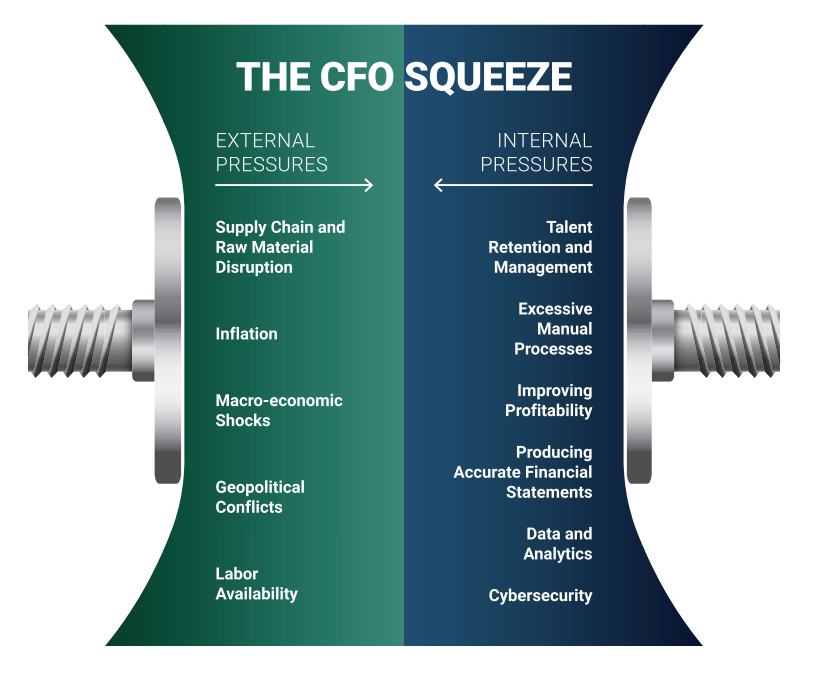

CFOs are getting squeezed from both internal and external stakeholders as well as macro- and microeconomic forces. Lingering effects from the COVID pandemic have resulted in supply chain disruptions, inflationary cost pressures, and rising interest rates to tame inflation. These factors, combined with increased geopolitical conflicts and instability, have created an external environment where the only certainty is that there will be continued uncertainty. At the same time, the CFO’s role is continuing to grow and evolve, with demands and responsibilities both increasing. Aside from the core finance functions, CFOs are increasingly relied on to provide holistic organizational support, including strategy & operations, data & analytics to support decision-making, and corporate development. CFOs need to do more with limited time, and in some cases, lack of talent. As a result, CFOs must automate, increase efficiency, and improve the skills of the organization.

Even Though the Title Is the Same, the Job Is Most Likely Not

The CFO’s role continues to evolve. Ten to fifteen years ago, CFOs were mostly focused on core finance functions including accounting and financial reporting, treasury, and investor relations. In today’s competitive business environment, expectations of Finance have shifted from tactical execution to strategic decision-making. Ongoing advancements in data and technology continue to be made, and similar advancements are expected across the Finance organization. Business leaders are looking for analytics and insights, real-time information, and scenario planning to make decisions, and are increasingly relying on Finance to provide that information.

During the past decade, the CFO role has expanded to include more of a strategic lens; the lines between CFO, COO, and CEO are becoming less defined, regardless of industry. An increasing trend is of a combined CFO-COO which, while not unexpected at smaller organizations, is now also occurring in larger companies such as PepsiCo Inc., Occidental Petroleum Corp., Afl ac Inc., and WebMD.1 In some cases, CFOs are also in line to succeed the CEO, traditionally a role taken by a rising COO or division president. In fact, more CFOs are becoming CEOs than ever, with 8.1% of CFOs at some of the largest companies promoted to CEO in the first half of 2022, compared to 5.6% in 2012.2

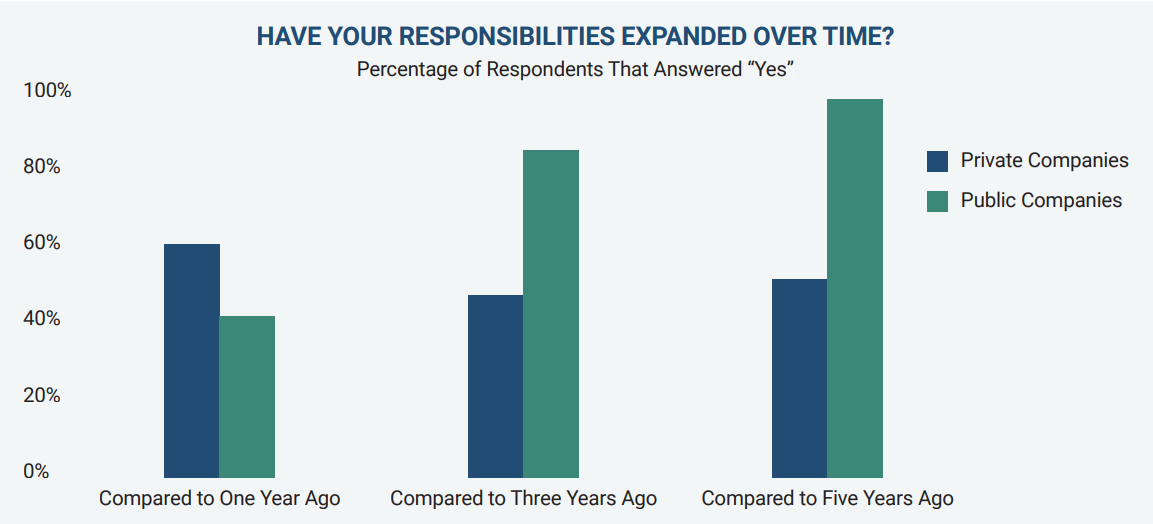

More than 50% of respondents agree that their responsibilities have increased. The majority of public company CFOs have seen their role expand steadily during the past three to five years while their private counterparts have experienced a more pronounced uptick in the past twelve months. New responsibilities include areas such as business intelligence and data analytics, corporate strategy, and procurement. Some also noted added responsibilities in non-core finance areas such as sales, operations, and supply chain.

Not Your Day Job but Still Your Headache

Diving deeper into some of the specific responsibilities confirmed a few notions; as expected, 100% of CFOs maintained their purview over bread and butter areas such as controllership, accounting, FP&A, and treasury. However, outside of the core finance areas, it became more mixed. In particular, less than 30% of CFOs surveyed have ownership of IT and cybersecurity, despite risk management being a key area of responsibility of every respondent. Most companies have a CIO or CTO who often reports directly to the CEO, so while it is not unusual for IT and cybersecurity to fall outside the CFO’s umbrella, it is important for the CFO to be involved in managing this issue that impacts enterprise-wide risk.

ESG is no longer a novel concept. Firms are increasingly challenged over their environmental, social, or governance-related policies by a multitude of internal and external constituents. ESG-related disclosure requirements are increasing, whether from the SEC’s proposals, lenders, municipalities, and governmental agencies, or even a company’s own employees. Less than 25% of CFOs in our survey have ESG or ESG-related topics as a core responsibility, as this subject often falls under other functions such as the legal organization, the COO, CIO, or a Chief Sustainability Officer (CSO). However, due to the strategic and risk-related elements associated with ESG, like IT and cybersecurity, it is important for the CFO to be intimately involved in the organization’s ESG strategy.

Another area of inconsistency in CFO roles was related to corporate strategy and M&A. While more than 3/4 of respondents have one or both corporate strategy and M&A strategy and execution responsibilities, they do not always have both. This variation could be due to a separation of roles, reporting lines, or that M&A is not part of the broader strategy. As with other non-core finance areas, the CFO’s role related to corporate strategy and M&A will vary differently across organizations.

It’s All About The People

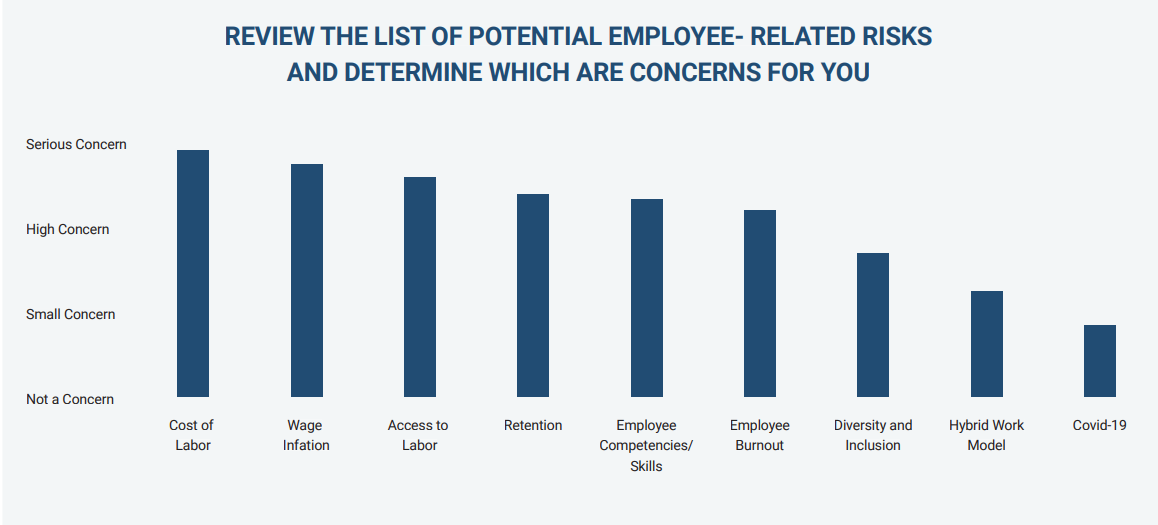

People-related issues are a major concern for most of our finance leaders. Although COVID and remote work was not an issue for the respondents, nearly every other area was – regardless of the size of the company or if it was public vs. private. Cost of labor, access to labor, retention, wage inflation, employee burnout, and employee competencies were all high or serious concerns. To manage these competing forces, companies will need to engage in a delicate balance between managing talent, cost, and employee sentiment.

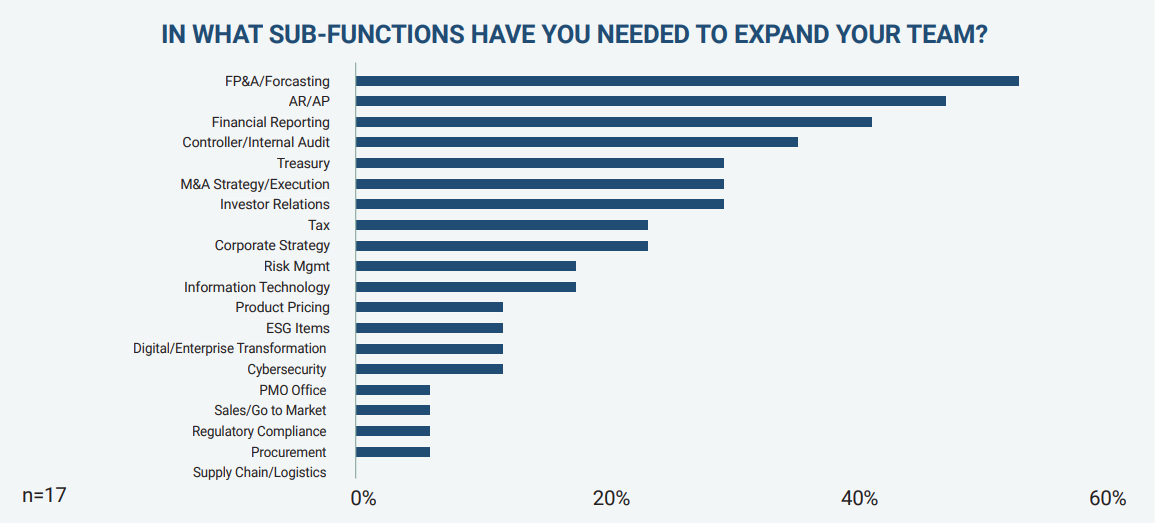

As a result of the increasing demands and changing role of finance organizations, about 75% of our respondents have also added resources across their teams. More than half increased talent in FP&A and forecasting. Core finance areas such as AP/AR and financial reporting were also major areas where teams were expanded. In addition, almost 1/3 of respondents that increased teams also did so in controllership/ internal audit, investor relations, M&A, and project management. Despite some CFOs adding supply chain as a responsibility and some showing concern about this capability, none of our respondents indicated that they had added personnel to this function.

Nearly 86% of our executives had concerns about data & analytics capabilities in their organization. Technology is also developing at breakneck speed, but teams are not necessarily able to keep up, often due to a lack in resources, skills, or time. To properly support their organizations, finance teams will need to become more efficient at core responsibilities and upskill their talent.

Scotty, We Need More Power!

A day rarely goes by without a major cyber-related hack or incident. Cybersecurity is a universal source of unease across the respondents, with ~ 83% citing it as a high or serious concern. This issue continues to increase and is not going away. Like ESG, as a risk officer, the CFO has the responsibility to be involved in the company’s cyber strategy whether it officially falls under their oversight or not.

Additionally, there is angst, especially with smaller organizations, with the selection of ERP and data visualization tools. This can be a daunting process. Technology is rapidly changing and it is difficult to know where to start or what is right for the company. It is important to fully evaluate and define both current and future needs and usage to identify the right tools and systems for the company and its situation.

Nobody Has A Crystal Ball

After the turbulent events in 2022, we are all wondering: what could the future bring? We asked our group of executives to opine on the state of the U.S. economy. The responses were split nearly perfectly, with half of respondents believing that the U.S. will be in a recession in 12 months and the other half thinking the economy will already have rebounded.

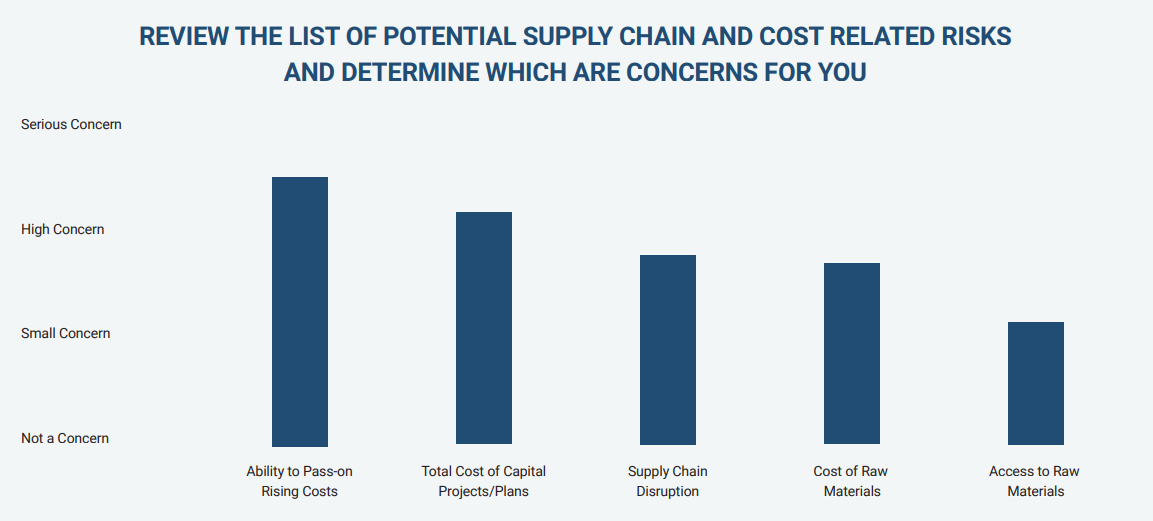

In terms of external forces on executive’s minds, the ability to pass on rising costs was listed as a high or serious concern by 97% of our respondents. Other areas such as supply chain disruptions and access to raw materials were also concerns but were much less critical to our executives.

Following a year with below average M&A activity, 70% of our respondents expect to engage in some form of M&A during the next 12-18 months with 40% suggesting that it is extremely likely they will execute some form of M&A.

As respondents contemplate M&A, the main concerns, particularly with smaller and medium sized private companies, are the ability to raise debt and having sufficient resources and expertise available. Public companies are less concerned with access to funds but, like their private counterparts, are also worried about skills and resources needed to execute a successful transaction.

What To Put In Your Lunchbox

The role of a CFO continues to be squeezed from both internal and external forces. Increased responsibilities and demands within the organization, heightened economic volatility and uncertainty, and workforce challenges have provided immense headwinds. To manage this difficult environment, CFOs, and finance leaders should focus on some areas with high impact:

Taking actions to ensure the finance organization is more nimble and flexible will enable the CFO for success and position the company to navigate and even thrive in the coming year.

Appendix

The Ankura CFO Survey had a total of 30 respondents including CFOs, senior financial executives, and board members. Our analysis and conclusions include instances where respondents that identify as CFOs by title have been isolated as a group. In these instances, we have footnoted this change to the new set of respondents, by noting (n) is a number less than 30.

© Copyright 2023. The views expressed herein are those of the author(s) and not necessarily the views of Ankura Consulting Group, LLC., its management, its subsidiaries, its affiliates, or its other professionals. Ankura is not a law firm and cannot provide legal advice.