Expect a much closer focus from bank regulators on interest rate risk management in the wake of bank failures involving Silicon Valley Bank (SVB) and Signature Bank.

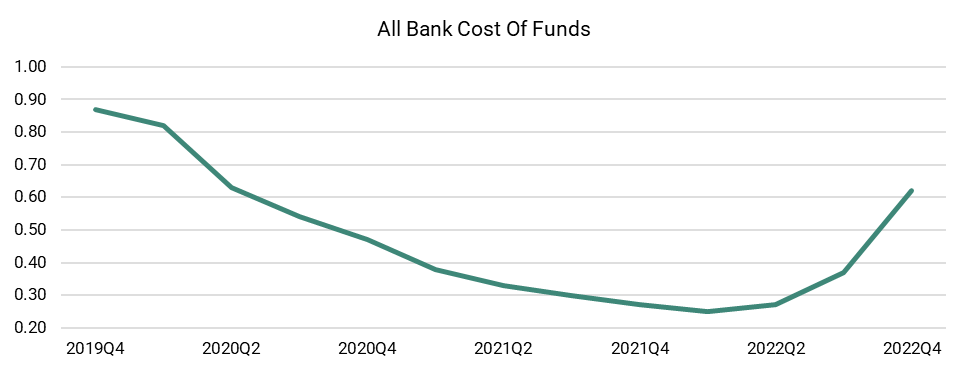

The interest rate risk focus is not new but has been ignored by regulators and many bankers amid a nearly decade-long period of extended low-interest rates. The result: seemingly low-risk banks have, in fact, taken on far more risk in an effort to reach for more yield.

The volatility at SVB, which led to its demise, was in part due to fast growth and misestimation of the duration of its funding base. In effect, SVB had far more hot money than management or its regulators thought. Compounded by long-term, low-yielding assets that were far underwater, the bank ultimately had a severe liquidity crisis.

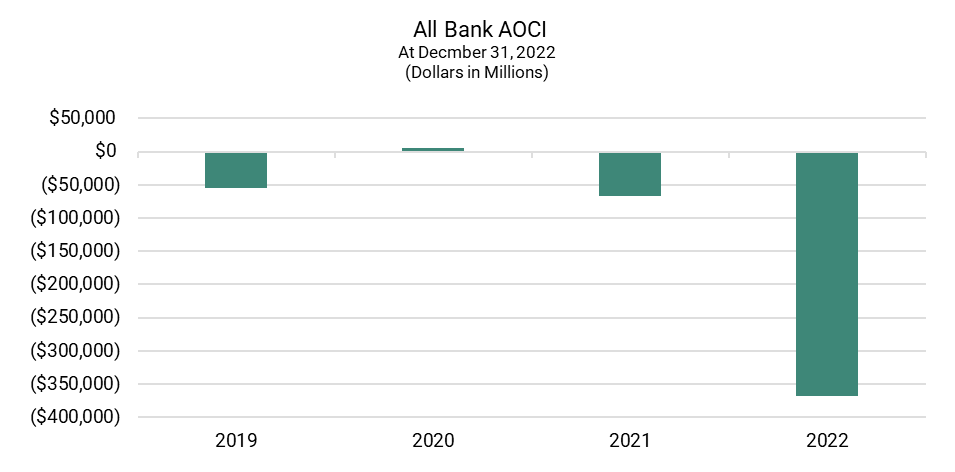

The existence of substantial interest rate risk is evident in the Accumulated Other Comprehensive Income (AOCI) account to equity. AOCI is the loss that flows to GAAP (Generally Accepted Accounting Principles) capital on securities held for sale. For the business at large, AOCI has increased significantly from a $4.9 billion premium on December 31, 2000, to a discount of $367.5 billion at year-end 2022.

While AOCI, by itself, did not alone cause either Signature or SVB to fail, interest rate risk and embedded loss in investment portfolios made it very difficult for the bank to liquidate securities for cash.

Key Considerations for Community Banks

Out of the ashes of the latest banking crisis comes a series of steps community and regional bankers can take now to manage balance sheet risk and assure strong future performance. They are:

#1 Review Liquidity Sources and Current Stresses

Most banks have traditional liquidity sources: the Federal Home Loan Banks, Correspondent Banks, and brokered deposits. Most also stress liquidity. Now is the time to review collateral, borrowing lines, and stresses to ensure your bank can withstand significant changes to liquidity. While an SVB stress is unlikely for most banks, major layoffs in a community, economic dislocations, or weather-related tragedies could put pressure on a deposit base.

#2 Review Interest Rate Risk Tolerances

Banks routinely establish limits for loss of income and loss of economic value in a changing interest rate environment. Are these reasonable, given your bank’s capital base, asset-liability structure, and other risks on your balance sheet?

#3 Re-Validate Your Asset Liability Management Model

Now is an excellent time to revalidate the operations, key assumptions, and other factors that are part of your interest rate risk management models. Special attention should be paid to assumptions governing the decay of core deposits, including how the decay speeds were developed, prepay speeds on commercial real estate and C&I (Commercial and Industry) loans as well as other key assumptions driving the model. It is critically important to understand the “guts” of the model and how actual and projected performance varied.

#4 Conduct Due Diligence on Your Deposits

Due diligence on your own deposits means taking a strong, critical look at your deposit base. This would include reviewing large deposit relationships and assessing the strength of their relationship with your bank. Also, take a close look at the age of deposits, especially core deposits. Deposits that are comparatively young, defined as deposits between one and four years in your bank, are likely to be more vulnerable to run-off. Also, take a strong look at the depth of customer relationships, industry concentration, and other unsystematic factors that might affect your bank's deposit base.

#5 Project Pricing as Part of Measuring Core Deposit Intangibles

One of the big challenges for banks in acquisition has been projecting pricing as part of measuring core deposit intangibles. Banks largely have been reluctant to raise deposit costs and, until now, have been sluggish in doing so. Depending on deposit due diligence and a strong understanding of customers, it may be time to re-evaluate pricing decisions and structures.

Regulatory Response: What We Expect

At its core, both SVB and Signature Bank were both management and regulatory failures. We, therefore, expect regulators to be more sensitive to interest rate risk plans and management strategies. Regulatory tools include “Matters Requiring Attention” and Cease and Desist orders.

Do not be surprised if regulators begin pulling supplemental capital requirements from their toolbox. These capital requirements were first promulgated in the late 1980s and permitted regulators to incorporate incremental capital based on interest rate risk exposure.

Expect the focus to be on banks that are at or exceed previously set exposure limits to economic capital value or with excessive swings in net interest income.

How Ankura Can Help

The Ankura valuation and risk management services range from model validation to assistance with interest rate risk management, due diligence on deposit bases, and the valuation of loan portfolios, complex securities, core deposit intangibles, and customer relationships.

Our senior team has, on average, over 25 years of work experience in the financial services industry. This team has assisted clients in performing hundreds of deposit base studies and is well-positioned to assist in analyzing your deposit base and comparing the results to comparable institutions.

We bring extensive banking expertise to our engagements, including financial analysts, former CFOs, and former investment bankers.

© Copyright 2023. The views expressed herein are those of the author(s) and not necessarily the views of Ankura Consulting Group, LLC., its management, its subsidiaries, its affiliates, or its other professionals. Ankura is not a law firm and cannot provide legal advice.