How the CFO (Chief Financial Officer) and CHRO (Chief Human Resource Officer) Partner to Define Employee Impact and Drive Individual Relevance

This article is part of a collaboration inside The Culture Lab at Ankura where experts from different fields come together to tell a more impactful story about business outcomes. For this session, Elliot Fuhr from the Ankura Office of the CFO® and John Frehse from the Global Labor Practice help leaders turn the tide of turnover by making every employee relevant.

With a labor shortage that is not going away for at least the next two decades, the battle to hire and retain talent will remain in the headlines. Everyone has an opinion about why we have this shortage, why employees leave their jobs (51 million of them in the United States in 2022)[1], who is to blame, and what we should do about it. Almost everyone is wrong. Although the reason for the labor shortage is mostly due to demographic issues combined with historically high wealth creation, retaining talent is more complicated, and partially psychologically driven – largely by whether an employee feels relevant inside a corporate culture.

But how impactful is relevance? Employees are 48% more productive when they feel they and the companies that employ them are relevant. Ankura identified employees who view themselves as “good fits” ( i.e. relevant) as 20% more likely to become top performers. Recognizing relevance is a significant lever management can pull to make a large difference. But leadership teams are failing at this powerful strategy. 39% of employees surveyed by Ankura say the management team cares about them and only 33% say leaders communicate effectively. Needless to say, there is much work to do.

Feeling Relevant as an Employee

Feeling Relevant as an Employee

What drives relevance? The immediate and most prevalent response is that we do not pay people enough. The thinking goes, that to solve retention, we must throw money at the problem. If we pay employees more, they will feel more valuable and stay. Yes, there are industries where employees are chronically underpaid and increases can make a difference, but this is the exception, not the rule. Also, unfortunately, the data does not prove that this is a singularly dominant factor. Payscale.com did a study of 70,000 professionals and found that for companies that overpaid workers, 35% still felt they were underpaid. For those paid at market value, 64% said they were underpaid [2]. Not only can we not pay our way out of this, even when we try, more than one-third of the employees will not give you credit for doing so.

Other than money, what really impacts a feeling of relevance and how can leaders make an impact? There is no simple answer, and that is why retention remains such a problem. Leaders often look for the “silver bullet” or the singular cause of the problem. In this case, the answer is a large basket of approaches to employee engagement and empowerment. Relevance comes from many areas of a company’s culture, especially from an employee’s ability to make an impact and to be recognized for it. However, to make any type of impact, employees must be capable, trusted, have access to the information they need to be effective, and have the decision rights to act on this information.

We can make it a math equation:

Being Capable + Trusted + Having Access to Information + Decision Rights = Being Relevant

Being Relevant = Increased Employee Retention and Performance

Finding capable talent is becoming even more challenging as digital transformation, automation, and innovation are pushing skill requirements to new levels; levels at which the qualified workforce is in short supply. Although lower-value tasks are automated allowing higher-value tasks to receive more attention, retaining highly skilled employees requires leaders to have the tools to specifically recognize individual workforce performance and where it drives company performance. The skilled workforce demands it.

Assess Trust

Frances Frei, the sometimes-controversial Harvard Business School professor, is obsessed with trust. She, along with Ann Morris, created the “Trust Triangle” construct that posits empathy, logic, and authenticity are the three keys to earning trust from the workforce. Without strength in all three categories, employees will struggle to trust their leaders and are likely to turnover. It is widely understood that employees are generally leaving due to their immediate supervisor and not the company, and the three pillars of trust are the reason.

Aron Ain, the former longtime and universally loved CEO of UKG, is equally obsessed with trust – he even wrote a chapter of his last book entitled “Trust.” He is logical, overwhelmingly authentic, and his employees always knew that he cared about them (empathy). They trusted him. But he also trusted them and that unlocked performance. They knew they were relevant to the business because they had decision rights and access to the information they needed to make great decisions. Aron extended the concept of trust to every part of the business, including how the products UKG offers were designed. UKG technologies were initially built to drive governance and compliance related to timekeeping and managing the employee lifecycle. They evolved into so much more including emphasizing individual employee impact through measuring productivity and performance. UKG workforce management and human capital management tools give employees access to information so they can make better decisions faster and allow leaders to recognize employee performance in a timely and impactful way. This recognition is critical and often so difficult to do. It is not that leaders do not want to recognize their employees; they simply do not have the information needed to do so effectively.

A key indicator of employee trust is accessibility to relevant information needed to highly function in a role. We call this phenomenon the Google Effect. That is the entire business model of Alphabet, Google’s parent company. They provide access to information in a useful format so individuals can make better decisions faster. Whether it is through Google Maps, Google Search, or Gmail, every product at Google does the same thing – providing this access. This simple business model has created a company with a $1.2 trillion dollar market capitalization.

Organizations face two main challenges when trying to unlock the power of “access to information.” The first is that they have very serious concerns about what would happen if employees had access. Would the company fall apart? Would employees riot in the streets knowing the facts? Or would they have deeper insights allowing them to better serve the company? Access does not mean giving them all the information from every division of a company, but rather the useful and relevant information so they can make better decisions faster.

The second concern is that useful information is often not readily available. Yes, large databases exist, but how do we mine them for relevant information and deliver that to the people who need it in a timely manner? Technology platforms are getting better at delivering useful information, but we are at the early stages of evolution. Many corporations now use three or four different business intelligence tools, and this creates more complexity and less governance. Workforce management and human capital management tools are largely SaaS models and have begun to offer insights into the workforce with clear and flexible dashboarding instead of export tools allowing you to wrestle with the data in Excel. This democratization of information is happening, just not as fast as organizations require.

Decision Rights

Without the information needed to make great decisions, leadership would be irresponsible to give their workforce decision rights. If employees can see what is going on inside their area of the business, it will help them develop a point of view on what is going well and what needs improvement. Knowing where opportunities exist, great employees are going to want to make an impact. If they do not have decision rights, they will leave. What better way to show an employee they are relevant than to let them exercise their point of view through decisions? This allows them to make an impact. Whether large or small, each time an employee makes a decision they are demonstrating their relevance.

When co-author John Frehse first started at Ankura, he had come from running his own business and was used to making all his own decisions. When he needed to make his first big decision inside the organization, he went to his CEO, Kevin Lavin, and asked permission. Kevin said, “I trust you to make the decision, and let me know if you want to discuss it.” That was both empowering and terrifying for him. This trust deserved to be honored with the hardest work possible to make the best decision possible. Decision rights make us better, make our companies better, and are a clear proof point of trust. People who are allowed to make decisions are always relevant.

Articulating Relevance Through the Office of the CFO

We know the CFO shares quantitative data that definitively and clearly articulates whether the company is winning or losing. It turns out high-performing employees want the same feedback about their own performance. As offensive as this sounds, Operations and Human Resources leaders need to get an education from the CFO. The financial function is very focused on performance and requires accurate and granular data to articulate results, and everyone pays attention when they report. What do these metrics look like and how do we make them employee-centric? This is a sample of traditional metrics that matter to the CFO:

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) - is generally the key metric used to determine the rough enterprise value of the business. It is the story of profitability.

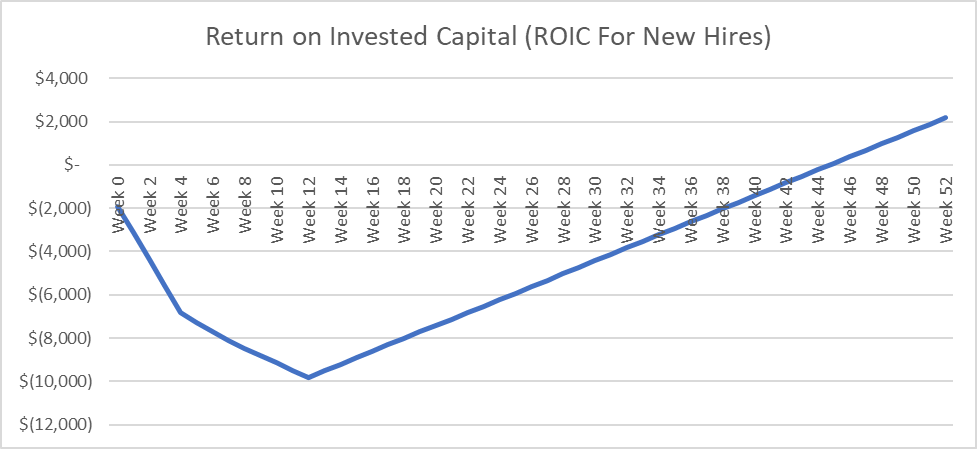

ROIC (Return on Invested Capital) - you put money into the business, what is the return on that investment.

FCF (Free Cash Flow) - is the cash produced by a company through its operations, minus the cost of expenditures. In other words, free cash flow is the cash left over after a company pays for its operating expenses and capital expenditures (CapEx).

Debt/Equity: The debt-to-equity ratio (D/E) is a stock metric that helps investors determine how a company finances its assets. The ratio shows the proportion of equity to debt a company is using to finance its assets.

If we focus on Return on Invested Capital as an example, we can translate this concept into a human resources metric extremely relevant in today’s job market. High turnover and “job hopping” are growing as trends marked by the 51 million people who quit their job in 2022 in the United States. High cost, zero value, short-term employees can destroy profitability. The cost of hiring, onboarding, and training the high volume of employees starting a new job is enormous. If they leave in the first 90 days, we often do not get any return for this investment. What we learn through the Ankura survey is that employees feel more positive about their supervisors by 90 days in comparison to at the start of employment, but have increasingly negative feelings about senior management. This negative sentiment contributes to short-term turnover and, by recognizing the data, senior management can adjust behaviors to decrease the losses.

The analysis may also indicate hiring fewer employees with better qualifications will allow leaders to give attention to talent most likely to stay and succeed. It may cause short-term pain, but long-term stability.

The Conclusion

High-performing employees deserve high-performing leaders. If we have empowered our workforce to be relevant, we owe it to them to recognize the impact they make through quantitative and individual results. This allows individuals to know that others see them for the time and effort they expend to drive meaningful results.

We ask ourselves subconsciously every day whether we are relevant. We want to know this in relationships, communities, and in the careers that make up our lives. Relevance drives behaviors. Leaders who understand this can drive high levels of individual relevance and sustained human performance. They need to believe this works and have access to the information and tools to drive it. This means a new and different relationship between Human Resources and Finance where employee performance metrics are more dynamic, accurate, and clearly correlate to an employee’s impact on business success.

[2] https://hbr.org/2015/10/most-people-have-no-idea-whether-theyre-paid-fairly

© Copyright 2023. The views expressed herein are those of the author(s) and not necessarily the views of Ankura Consulting Group, LLC., its management, its subsidiaries, its affiliates, or its other professionals. Ankura is not a law firm and cannot provide legal advice.