Evidence suggests cannabis, also known as marijuana, has been in use for thousands of years beginning with ancient civilizations. However, the modern history of cannabis arguably began in the early 20th century. It can generally be defined by a shifting cultural tension between prohibition and legalization. As debates over the relative costs and benefits of cannabis use continue, a growing industry has taken shape with a wide array of regulations among states within the United States ranging from fully illegal to full legalization. Examples of qualified legalization are medical use, decriminalization (recreational), medical use and decriminalization (recreational), and CBD “cannabidiol” with THC “delta-9-tetrahydrocannabinol” only. The following map of the United States illustrates the current legal status of cannabis use by state:

Next to alcohol, cigarettes, and coffee - which are legal in most parts of the world - cannabis is by far the most popular drug. Even though cannabis is not federally legal in the United States, the combined populations of states in which cannabis is legal, decriminalized, or allowed for medical use within the U.S. represent the largest market in the world. After the U.S., Canada, which legalized cannabis nationwide in 2018 represents the next largest market.[1] Estimates vary but the current market for cannabis in the U.S. is approximately $32 billion, projected to grow to between $52 to $78 billion by 2030 as illustrated by the graph below:

Current Market and Headwinds

While cannabis is a large and growing industry, it faces a number of difficult challenges. In spite of the demand implied by growth projections, heavy regulation, and federal illegality among other factors present significant headwinds. Cannabis cannot be sold through interstate commerce. One implication of such a restriction is an inability to scale operations. For instance, if it were more economical for a business to operate a single, large marijuana farm in a given market to serve two or more states, they are prohibited from doing so by federal law. Therefore, in this example to meet the demand in this same geographic market a grower would need to operate separate farms and distribution would be limited to each individual state where they operate which has implications across a company’s entire cost structure. Additionally, federal laws significantly restrict a cannabis company’s access to and cost of capital. Due to this restriction, national federally insured institutions may not lend to this industry. As a result, only regional banks are able to offer lending to cannabis companies. This significantly limits financing options for cannabis companies. This can have noteworthy implications as to how a cannabis company conducts operations including a need to self-fund working capital. In fact, per some analyst estimates only about 10% of all U.S. banks and about 5% of all credit unions provide cannabis banking. Smaller banks, regional lenders, and credit unions that typically extend credit to the cannabis sector have also recently been flagged by analysts as facing disproportionately higher risk from turbulence caused by the failures of Silicon Valley Bank, Signature Bank, and the Swiss government-brokered deal for UBS to buy Credit Suisse.[1] This increased risk and turbulence faced by a key source of capital has the potential to further limit already thin financing options for cannabis companies. A recent attempt at federal legislation to allow cannabis companies greater access to capital failed. Despite widespread support, the Secure and Fair Enforcement (SAFE) Banking Act, a proposed legislation aimed at allowing banks to do business with companies operating legally within states that have legalized marijuana failed to pass in Congress in December 2022. The measure was intended to prohibit federal regulators from punishing financial institutions for providing services to cannabis companies, their owners, and employees. It would have also clarified that funds obtained from state-regulated and compliant cannabis businesses would not be considered as derived from illegal activity and provide protection against federal liability for banks, insurers, and other financial institutions that work with such companies.[2]

Another significant barrier to profitability in the cannabis industry is significantly disproportionate taxes. Cannabis companies are treated like illegal narcotics traffickers under the federal tax code.[3] The Internal Revenue Code (IRC) disallows all deductions or credits for a business that sells or otherwise traffics marijuana. The one major exception to this is the ability of a participant in the marijuana industry to reduce gross receipts by cost of goods sold to determine gross income.[4] However, this still can translate into 40 – 70% of a cannabis company’s income going towards taxes.[5]

Factors present in the cannabis industry such as heavy government regulation, high-cost structures, and lack of access to capital can lead to financial distress in any industry and in turn a need to restructure. Another factor leading to financial distress in the cannabis industry is competition from the black market. Legal marijuana markets across the country are struggling to compete with non-taxed, illicit businesses, where consumers get better deals, despite potential health risks. While it is an issue in states where cannabis has been legalized like Colorado, Michigan, and Washington, it is an even bigger problem in other emerging markets. For example, the licensing program in New York is years behind the state’s sophisticated black market. New York issued its first set of dispensary licenses in late 2022, but recreational marijuana has been legal in the state for nearly two years. Therefore, there are large numbers of stores masquerading as safe, legal entities that are not licensed. In fact, as of the end of 2022, none of the 36 newly licensed dispensaries in New York had even started operating. The problem is particularly cumbersome in New York City where it is estimated there are tens of thousands of illegal businesses.[6] The black market is such a problem, it is estimated to be approximately $60 billion, or as you can see from the graph on page three nearly double the size of the current legal market.[7]

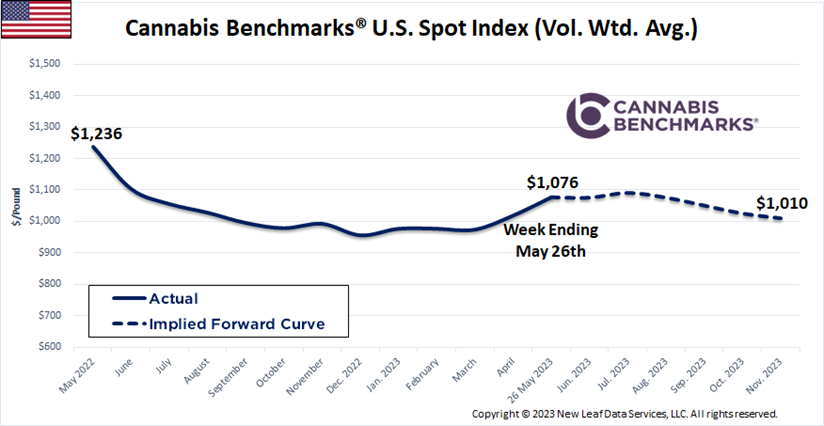

Historically most of the investor focus on the cannabis industry has been on demand. Demand has been and is expected to remain relatively flat. An increase in legal demand is expected to come from a shift from currently illegal markets to becoming legal. Demand cannot be analyzed without taking supply into consideration. Consumer participation in the legal cannabis markets is driven heavily by price. Especially, participation is driven by price in the legal markets relative to illegal markets. Competition based solely on price can be harmful to businesses in any industry as it has the potential to create a pricing race to the bottom and cannabis is no exception. When businesses compete on price, profit margins are compressed, and businesses fail. The total cultivated output of cannabis in the U.S. in 2022 (including illicit cannabis) was 48.8 million pounds. This figure encompasses all delivery methods, including flower, edibles, concentrates, and other products. Because the U.S. legal cannabis market is prohibited from interstate commerce the supply of cannabis is fragmented and state specific. States including Oregon and Michigan for example currently face an oversupply, and prices in these markets have collapsed as a result. Some licensees in these markets are calling for cannabis business licenses to be curtailed.[8] The relationship between supply and demand combined with competition from the black market has resulted in price erosion of approximately 12.9% for legal participants in just over one year with further deterioration of an additional 5.3% projected.

In this young industry you will also often see companies positioning the head of their cultivation department to be the primary leader of the organization. They will want this person to be an expert in growing cannabis. This person may not possess expertise in managing people, finance, accounting, sales, and other key business functions. Unfortunately, in many instances, this has led to mismanagement. A lack of experienced, sophisticated management capable of successfully navigating challenging circumstances further compounds an already daunting list of challenges facing the typical cannabis company. A need to increase the level of professionalism and business acumen of management is a common characteristic among cannabis companies.

Restructuring Considerations

Unfortunately, as discussed in more detail in the following paragraphs the federal illegality referenced previously keeps one of the most powerful and often used processes to restructure out of reach, a proceeding under Chapter 11 of the United States Bankruptcy Code.

The United States Trustee Program (UST) is a component of the United States Department of Justice that is responsible for overseeing the administration of bankruptcy cases and private trustees. As a general matter, UST policy largely bans cannabis companies from filing for bankruptcy because cannabis is illegal at the federal level. This has historically resulted in cannabis companies restructuring through various state court alternatives such as receivership. Receivership is a state court-appointed solution that can assist creditors to recover funds in default and help troubled companies to avoid or as an alternative to Chapter 11 bankruptcy. In receivership, the owner of a company maintains a limited role in the debt restructuring process. An independent receiver is appointed by a court. The court’s order appointing the receiver determines the scope and authority of the receiver. Unlike Chapter 11 bankruptcy driven by a uniform federal code, receivership can be less predictable and vary considerably from state to state and court to court.

An example of recent financial distress impacting a cannabis company and one that is attempting to restructure through a state court process is Chalice. Chalice, a Canadian holding company whose assets are all in Oregon and which operates 15 dispensaries in the state, on May 23, 2023, asked the Multnomah County Circuit Court to place five of its subsidiary companies under the control of a receiver. The May 23rd filing reveals a dire financial situation: Chalice’s Oregon subsidiaries are insolvent, owe more than $35 million to the parent company, and cannot, according to court filings, pay their obligations. “This situation has led to an urgent liquidity crisis for the defendants. They are unable to pay key suppliers and have recently failed to make payments to creditors, including lenders, landlords, suppliers, and others,” according to the court filing, adding that such inability to pay rent is leading landlords to threaten to seize rented property from Chalice dispensaries. The plaintiff in the filing is Chalice Brands, the publicly traded parent company based in Toronto. The defendants in the case are five Oregon subsidiaries. The parent company is seeking a buyer for all of its assets through the process.[1]

There is a glimmer of hope for cannabis companies in search of using Chapter 11 to restructure their affairs. A recent ruling by a judge in the bankruptcy court for the Central District of California signals a potential end of the UST’s “zero tolerance” policy for cannabis companies’ use of Chapter 11. As background, The Hacienda Company, based in Beverly Hills, CA, stopped operating in February 2021 and transferred its property to Lowell Farms Inc., a publicly owned Canadian company. In return, Hacienda received 9.4% of Lowell’s shares. Lowell sells and grows cannabis in Canada, where it is legal. Hacienda filed for Chapter 11 in the U.S. Bankruptcy Court for the Central District of California in September 2022 and proposed a plan to liquidate after paying creditors with either its Lowell shares or the proceeds from selling the shares. The case was assigned to Judge Neil W. Bason. The UST attempted to have the case dismissed because cannabis is illegal at the federal level. But on January 20, 2023, Judge Bason published an opinion allowing the Hacienda Company’s Chapter 11 to proceed, saying the company had removed its wholesale cannabis product manufacturing and packaging business by the time it filed and was not looking to reorganize as a cannabis concern. Judge Bason’s opinion espoused a “middle road” interpretation of the bankruptcy code, in which a court assesses a would-be debtor’s facts and circumstances before deciding whether to let a Chapter 11 case continue. The opinion, while limited to the court’s jurisdiction, offers a glimmer of hope that businesses with former cannabis connections, and the right set of facts, could use bankruptcy to liquidate and pay off creditors.[2]

Conclusion

Cannabis is a young and growing industry. Like many immature industries, it presents considerable opportunity. However, the industry faces considerable headwinds to achieve profitable growth. Unlike other industries where high leverage has been a key factor leading to financial distress, numerous other obstacles to unlocking value exist in cannabis: access to capital, high costs, price erosion (black market and oversupply), and poor management. Many of these factors stem from federal illegality. This amplifies the need to carefully plan any investment in the cash-intensive cannabis industry and to conscientiously select a capable and highly qualified management team to execute any business plan. In the event that cannabis companies face a need to restructure, available alternatives are more limited than many other industries but recent rulings may signal changes on the horizon.

[1] https://www.statista.com/

[2] Source: High & Dry: Banking crisis to further choke funding for cannabis sector | Reuters 2023-03-24.

[3] https://forbes.com/ The SAFE Banking Act's Potential Impact on The Marijuana Industry 1/24/23 Dario Sabaghi

[4] https://www.politico.com/ Why Weed Companies Can’t Make Money 9/4/22 Paul Demko

[5] Internal Revenue Code section 280E

[6] https://insights.valley.com/ Commercial-insight, Top Challenges Cannabis-Related Businesses Face Dec 7, 2022

[7] CNBC Retail: Marijuana’s Black Market is Undercutting Legal Businesses December, 23 2022 author Stefan Sykes

[8] Per Amanda Reiman, researcher at cannabis intelligence company New Frontier Data

[9] https://thecannabisindustry.org/ In 2022, U.S. Cannabis Supply Exceeds 48.8 Million Pounds December 12, 2022 author Bethany Moore

[10] https://www.wweek.com/news/ Cannabis Giant Chalice Asks Judge to Place Oregon Subsidiaries in Receivership as It Faces Financial Crisis The third-largest dispensary chain in Oregon’s request for court protection signals deep trouble. It hopes to find a buyer May 23, 2023

[11] https://news.bloomberglaw.com/ Cannabis Ruling Offers Narrow Path to Bankruptcy Perks, James Nani February 9, 2023

© Copyright 2023. The views expressed herein are those of the author(s) and not necessarily the views of Ankura Consulting Group, LLC., its management, its subsidiaries, its affiliates, or its other professionals. Ankura is not a law firm and cannot provide legal advice.