The value of private equity (PE) deals in the healthcare sector has grown from <$2B in 2001 to $151 billion in deals in 2021.1 Barring government intervention, PE in healthcare is here to stay.

It is no secret that PE firms' primary focus is to create transactional value. Additionally, the goals of private equity differ from the more complex parameters faced by traditional health providers in delivering care across a broad spectrum of payers and patients.

Yet, health systems can learn from the ways private equity firms introduce structural changes to the operational and business model of acquired companies to reduce operating expenses, compensate physicians, introduce technological enhancement, and transition to value-based care.

Understanding these specifics may help legacy providers thwart the shift of profitable services away from health systems and enhance their operational models. Perhaps most importantly, it can reestablish traditional providers as the go-to partnership opportunity for primary care and specialty physicians.

1. Private equity focuses on parts of the market that are fragmented, which gives room for pricing opportunism and creates value through consolidation.

Providers are often fragmented geographically, which allows private equity funds to consolidate market power and strive for economies of scale. For example, ophthalmology has been a particularly attractive specialty to PE investors because it is a highly fragmented specialty: 68% of all eye care services are performed by independent eye care providers who work mainly in small practices.2

Typically, private equity firms seek to acquire a larger physician practice to serve as their “platform” to drive consolidation. The firm will then acquire smaller practices to gain market share and expand brand recognition. This consolidation strategy affords private equity the opportunity to negotiate favorable contracts with insurers and medical suppliers, lower overhead, increase utilization, and expand ancillary revenue streams.

Private equity acquisition of physician practices was associated with increased healthcare spending and utilization, according to a study published in JAMA Health Forum. The study found a 20.2% increase in charges per claim, an 11% growth in the allowed amount per claim, and a 37.9% rise in new patient visits subsequent to private equity acquisition.4 Although a potential cause for concern on rising healthcare costs, these statistics are not necessarily bad. If PE-backed providers are improving access to care, increasing clinical interaction, and addressing unmet demand, these expenses will likely decrease the cost of emergent care in the future. Additionally, technology investment may allow for AI-powered care coordination that may also yield benefits and reinforce the tenants of value-based reimbursement.

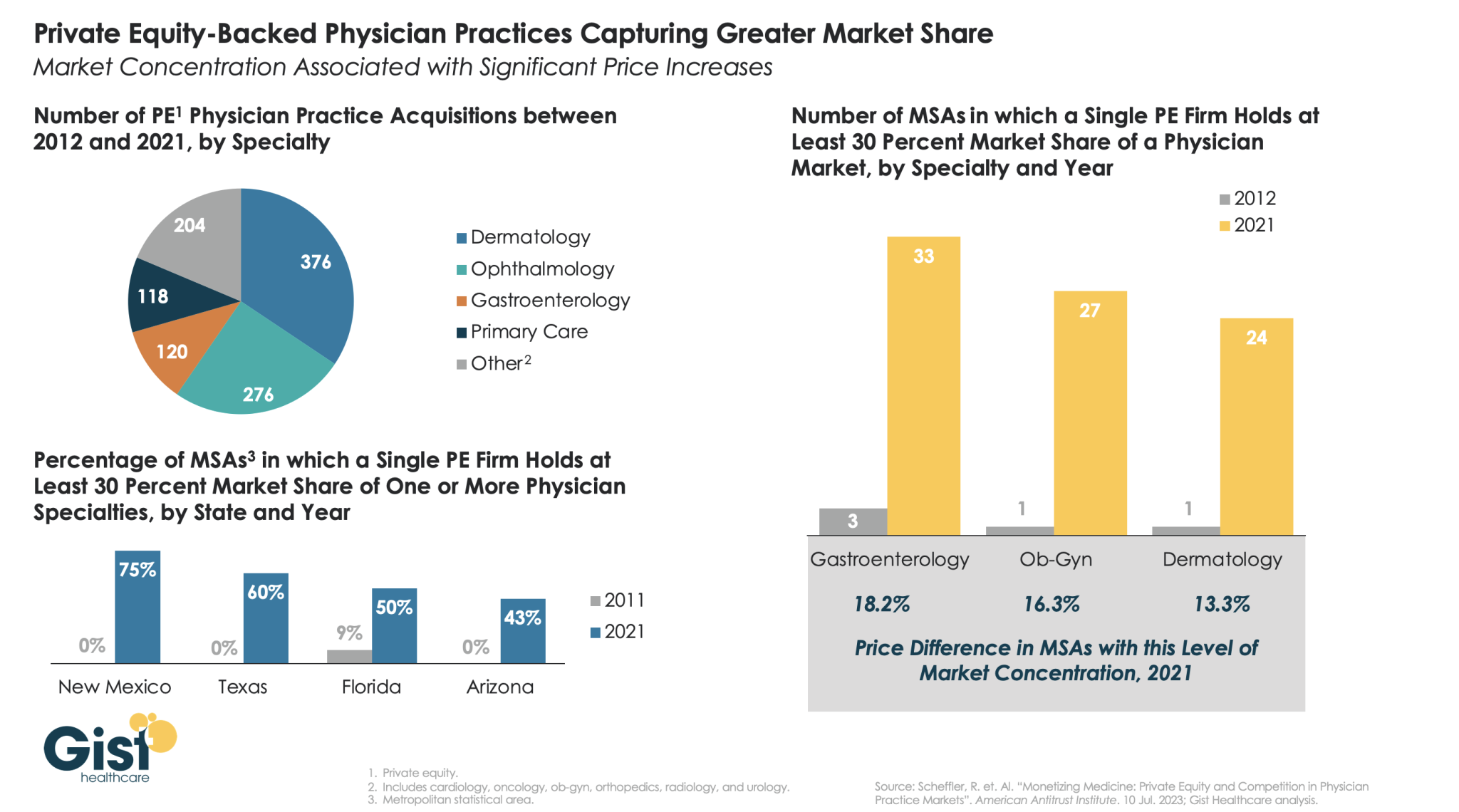

Image Source: Gist Healthcare, Private equity-backed practices flexing market share muscle, September 2023[5]

A study conducted by Gist Healthcare5 found significant concentrations for PE-backed practices (defined as greater than 30% market share) in over a quarter of the U.S. These concentrations tend to be more pronounced in states with fewer regulations and fast-growing senior populations.

Additionally, the study found higher healthcare prices in highly concentrated markets with PE acquisitions. As an example, the study showed an 18% price increase for gastroenterology in metropolitan areas with high PE concentrations.5

How health systems can respond

Similarly, health systems can look not just at large practices as acquisition targets but expand their sights to see if there are multiple small practices that make sense to purchase and bundle together.

2. Private equity firms focus on specialty clinics to create vertical integration.

Certain specialties expect to see an increased demand for care due to the demographics of an aging population, concurrent with a provider shortage in those specialties. A prime example is urology, which is currently an attractive investment target.6

Other sectors of interest such as dermatology, orthopedics, gastroenterology, and allergy are preferred because they are procedure-heavy and/or have investments in ambulatory surgery centers (ASCs) that allow them to collect facility fees that are often much higher than the reimbursement for a procedure in a physician office setting. These high-margin procedures or treatments can greatly increase profitability and help shift to a more favorable payer mix.7

In the case of ophthalmology, not only are PE firms interested in practices that own ASCs but also in vertically integrating specialties such as optometry, ophthalmology, and retina specialists. The combination of these specialties can provide cross-referral opportunities and a comprehensive solution for patients.2

How health systems can respond

Health systems can emulate the private equity playbook by consolidating fragmented physician practice markets. A potential avenue would be to establish hubs or centers of excellence for certain specialties to attract target physicians with coordinated care and improved patient access. Additionally, health systems can target certain surgical specialties and increase ‘stickiness’ by prioritizing partnerships or joint ventures with physicians on ASCs.

3. Private equity firms are gaining first-mover advantages in value-based care

Private equity firms also favor primary care clinics and “payviders” due to their central position in value-based care. With many payers emphasizing value-based care and a continuum of patient care, private equity companies can offer proficiency with risk-based contracting and value-based care to bring efficiencies to healthcare and increase access.6

Payers, funded by private equity, are making a long-term play in value-based care and recognizing that patient health outcomes are a critical component of their profitability. Active engagement with patients through preventive medicine and a greater emphasis on addressing the social determinants of health outside the traditional purview of medicine can lead to higher profits.8 Additionally, health plans recognize a financial incentive to invest in retail, urgent care, and after-hours centers to keep their members out of more expensive emergency departments.9

For example, Oak Street Health reports a 50% reduction in hospital admissions among its at-risk patients and a 42% reduction in 30-day readmission rates. Half of Oak Street's patients have either a housing, food, or isolation risk factor.10

The key to being successful in the healthcare ‘new world’ is to focus on best-in-class outcomes and lower costs. Although reimbursement has not caught up, PE firms are banking on the idea that having a developed and tested strategy in the value-based world may pull government payers closer to the value-based care model. They also know that it is highly likely that the early adaptors in this space will tend to reap the largest benefits. They expect government payers will start with targets that are at or near their current cost and pare those down as evidence and data prove cost reduction through care management.

PE firms are fueling the transition to value-based care with technology

Private equity investors are a natural partner to facilitate the transition to value-based care due to their availability of capital to drive investments in data and outcome management.6 The technology shift in healthcare and interoperability for electronic medical records (EMR) systems has increased the usage of data analytics to coordinate care across populations. Due to the large capital investments needed for advanced EMR systems, data analytics, and population management, physicians are realizing that increasing size and scale is crucial for remaining competitive in the modern healthcare environment.11

How health systems can respond

Healthcare organizations have several advantages in leading the transition toward value-based healthcare. Healthcare organizations are financing CMS waiver initiatives, through which they establish partnerships with physicians to improve outcomes and reduce costs, in anticipation of forthcoming reimbursement shifts. Alternatively, healthcare organizations that qualify for incentive payments from third-party payers can allocate a portion of the shared savings to the physicians who played a role in achieving the improved outcomes.

4. Private equity firms offer attractive buyouts and equity models

PE firms can often offer large buyouts for physician practices, many times at double-digit multiples of earnings. These large buyouts are typically accompanied by reductions to future physician compensation, reductions in overhead, and/or improved efficiencies in administrative functions.3

Secondly, private equity generally can offer the upside of a stock option. Typically, PE firms purchase a majority interest in a practice but still allow the physicians some equity in the practice. This gives the physicians some “skin in the game” regarding future growth. Also, PE firms generally anticipate a future sale in a three-to-five-year timeframe, and the physician equity holders can benefit from the future sale of the practice.2

How health systems can respond

While health systems are often constrained by regulations, there are several avenues available to compete with the financial incentives offered by private equity. First, health systems should highlight that PE purchase and compensation strategies can create dichotomies that may weaken a group as equity participants and employed (generally younger) physicians who have a broadly different benefit from the sale.

In addition, apart from the financial advantages that the private equity model might provide, collaborating with healthcare systems can yield various benefits for medical practitioners. Generally, healthcare systems operate with extended strategic planning horizons, affording them the ability to engage physicians for more extended periods. This can prove highly advantageous for physicians who prioritize stability or are dedicated to advancing value-based healthcare models. Moreover, whereas most private equity models concentrate on a specific medical specialty, physicians aligned with a healthcare system often enjoy greater integration with colleagues from a diverse array of specialties. This interconnectedness can be inherently fulfilling and enhance the coordination and administration of patient care.

“If you can’t beat them, join them”

Ultimately, health systems may choose to partner with private equity rather than directly compete. Coincidentally, this strategy played out similarly between health systems and ASCs. Historically, health systems were in fierce competition with ASCs. Health systems argued that ASCs were selectively attracting the more profitable surgical cases, while ASC operators maintained that ASCs offered low prices, high quality, and patient convenience. While this competition is still fierce in some markets, many health systems are now partnering with physicians and ASC managers through joint venture ASCs.

As reported in one recently published survey published in 2018, 41% of health system respondents “own or are affiliated with a freestanding ASC.”13 Particularly interesting, of those hospitals or health systems with current ASC ownership or affiliations, 48% “anticipate making additional ASC investments/affiliations in the coming years.”

Increasingly, there are newly emerging strategies such as health systems taking part in a regional Management Service Organizations (MSO), or in an ambulatory strategy with a third-party investor. In this model, the health system participates in the underlying capitalization table of the PE platform. Differing from an independent contractor arrangement or traditional employment model, the MSO structure can offer value to physicians. Health systems can consider the advantages that joining with PE companies can offer to enhance their physician alignment strategy.

Conclusion

Private equity investments in healthcare have accelerated the shifting dynamics of the modern healthcare industry. Private equity has pushed consolidation, vertical integration, and the transition to value-based care. Moreover, their large capital resources have attracted many physician practices and further fueled the technological shift in healthcare.

Consumers’ expectations are evolving faster than health systems can meet them. Driven in large part by advances in other sectors, like banking, hospitality, logistics, and other service industries, consumers expect to see the benefits of technology in the healthcare setting, including basic functionality — making appointments via an app, getting test results rapidly and on one’s mobile device, and being able to communicate with the care team through multiple modalities of virtual communication.

Health systems need to play offense when confronted with these new market forces. Because, in our experience, health systems that effectively play offense are more successful. Understanding the playbook of private equity investment, emulating it, and/or partnering with it, is a good offense.

Sources:

- Private Equity in Healthcare: Exploring the Challenges and Opportunities – UNC Center for the Business of Health

- The Growth Of Private Equity Investment In Health Care: Perspectives From Ophthalmology | Health Affairs

- Potential Implications of Private Equity Investments in Health Care Delivery - PMC (nih.gov)

- Physician Practice Costs Grew 20% After Private Equity Acquisition (revcycleintelligence.com)

- Private equity-backed practices flexing market share muscle - Gist Healthcare

- Private Equity in Healthcare – An Updated Review of Selected Niche Investment Areas (mcguirewoods.com)

- Every Picture Tells a Story: Private Equity Continues to Buy Up Health Care Services | American Council on Science and Health (acsh.org)

- Payers: A Shift from Insurance to Services | Bain & Company

- Market_Insights_MD_Ownership_Models.pdf (aha.org)

- Social-Impact-2021-Report.pdf (oakstreethealth.com)

- Hot physician specialties for private equity investment (beckersspine.com)

- Clark Hill Strasburger and Avanza Healthcare Strategies, Positioning Ambulatory Surgery Centers for Success , September 2018.

About the Authors

Mark Furgeson is a Senior Managing Director in the Ankura Healthcare Real Estate Strategy group. He helps healthcare providers evaluate and quantify capital investment in their physical footprint to ensure that their investments realize their financial value to the organization today and decades into the future.

A frequent speaker and recognized thought leader on healthcare valuation, Ankura Managing Director Robert Mundy’s key area of expertise is transactional healthcare valuation for regulatory compliance purposes. He has significant experience in valuing hospitals, ambulatory surgery centers, diagnostic imaging centers, radiation therapy centers, and physician practices, as well as in healthcare mergers and acquisitions.

© Copyright 2023. The views expressed herein are those of the author(s) and not necessarily the views of Ankura Consulting Group, LLC., its management, its subsidiaries, its affiliates, or its other professionals. Ankura is not a law firm and cannot provide legal advice.