Introduction

The senior living industry faces unprecedented pressure from rising minimum wages. In an industry already facing high labor costs, mandated increases - exemplified by California's $25 hourly minimum wage for healthcare workers - are forcing operators to fundamentally rethink their operational and staffing models. Analysis shows that while moderate wage increases to $12 per hour create manageable 5% cost increases, jumps to $15 threaten 13% cost surges, significantly impacting operational viability.

Forward-thinking operators are responding with comprehensive strategies that go beyond traditional cost management. Early adopters of AI-driven documentation systems are saving 8–12 hours weekly per nurse, while new staffing models featuring flexible schedules and career advancement pathways have reduced turnover by 30%. Innovative operators implementing mentorship programs for Certified Nursing Assistants (CNAs) have achieved significant retention gains, and predictive analytics platforms have reduced adverse events by 22% while lowering liability costs. Looking ahead to 2030, the industry faces fundamental transformation through consolidation, technological integration, and new care delivery models. Success will increasingly depend on operators' ability to achieve the necessary scale, leverage technology effectively, and adapt their service models to changing market realities while maintaining quality care.

In this white paper, we explore the changing wage environment, legislative and economic impact, market competition and labor dynamics, regional variations and operational constraints, technology-enabled operational efficiencies, and future industry transformation.

The Changing Wage Environment

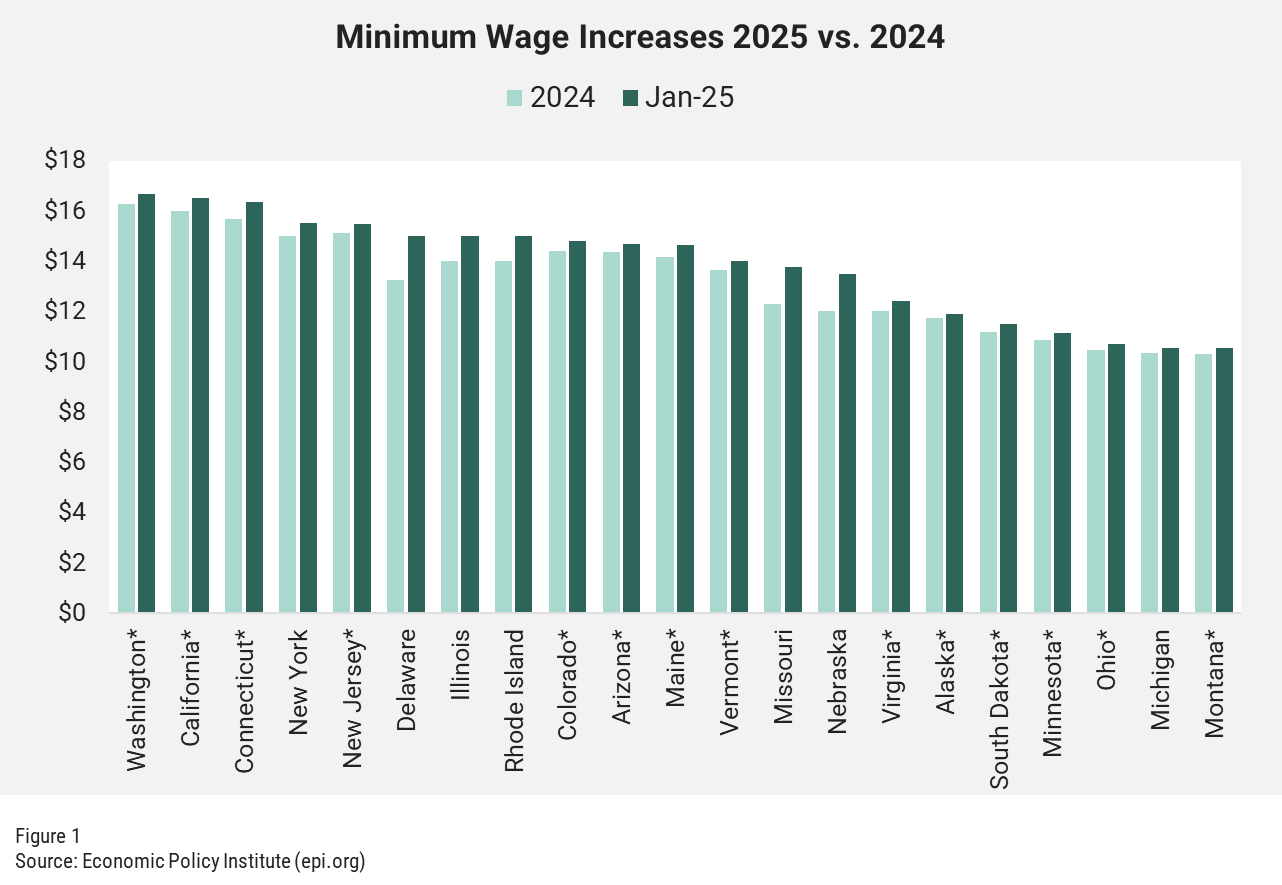

Rising minimum wage legislation across numerous states is exacerbating existing operational pressures within the senior living industry. With labor costs exceeding 60% of operating expenses, the 2024 implementation of wage increases in 23 states, and further increases scheduled through 2026, compels operators to fundamentally restructure their operational and staffing models to ensure quality care and financial stability.

This pressure comes at a particularly challenging time as the industry faces a critical demographic shift: the ratio of available family caregivers to older adults in need is projected to decline from 7:1 in 2010 to 4:1 by 2030, intensifying the need for professional care staff. However, demand remains strong, with projected 2025 occupancy increases across all acuity types - memory care leading at 83%, followed by assisted living at 68% and independent living at 65%. This combination of growing demand and a shrinking labor pool makes wage pressure management particularly crucial for long-term sustainability.

- Legislative and Economic Impact: The push for higher minimum wages reflects broader societal efforts to improve living standards for healthcare workers. With senior living wages already growing 30.9% from 2019 to 2023, outpacing the private sector by 6.5 percentage points, new mandates like California's $25 hourly minimum wage for healthcare workers exemplify the mounting pressure. Financial analysis reveals that while moderate wage increases to $12 per hour create manageable 5% cost increases, jumps to $15 per hour threaten 13% cost surges. This impact is particularly severe in senior living, where labor costs already exceed 60% of total expenses.

- Market Competition and Labor Dynamics: The industry faces intensifying competition for workers across multiple fronts. Healthcare settings offer higher wages and sign-on bonuses, while retail, multi-unit operations and gig economy options provide more flexible schedules with less demanding responsibilities. This cross-industry competition is especially challenging as demographic trends project a need for 20 million new aging services workers by 2040. Paradoxically, research indicates that higher minimum wages may delay retirement among low-wage workers, with each $1 wage increase reducing retirement rates by 2.3%, a trend that could partially mitigate staffing shortages but raises questions about workforce sustainability.

- Regional Variations and Operational Constraints: The wage pressure landscape varies significantly by region, creating complex operational challenges. High-regulation states face particular strain as wage mandates compound existing staffing requirements. Unlike other industries, senior living operators cannot simply reduce hours or automate core services to offset costs. This limitation is especially significant as state-level fiscal constraints—exemplified by California's $38 billion deficit—create uncertainty around wage mandate implementation and timing.

These unprecedented cost pressures, combined with limited ability to pass through price increases, are forcing operators to fundamentally rethink their operating models and develop innovative solutions that go far beyond traditional cost management approaches.

Short-Term Industry Response Strategies

- Introduction of flexible scheduling with 4-day workweek options

- Implementation of career ladder programs transitioning aides into licensed roles

- Development of apprenticeship programs showing 30% lower turnover rates

- Creation of relocation and housing assistance programs in rural markets

- Participation in subsidized training through the Care Across Generations Act

Senior living operators are implementing immediate and near-term solutions to address wage pressures while maintaining quality care. The most successful organizations are focusing on three key areas that show a measurable impact on both operational efficiency and cost management:

- Technology-Enabled Operational Efficiency: Operators are achieving significant efficiency gains through targeted technological investments that address key operational pain points. Electronic health records can yield an estimated net benefit of about $86K per provider over a five-year period with savings from improved charge capture and reduced billing errors[1]. AI-assisted tools can cut documentation time by 70%, saving physicians an average of 16 minutes per patient visit[2]. Additional opportunities include automating billing tasks, which can reduce administrative overhead by up to 20%, and payroll processes to ensure timely payments, reduce manual errors, and eliminate costly compliance issues, leading to significant savings in HR operations. Advanced monitoring and prediction systems can also aid in not only lowering costs but also enhancing care quality and operational efficiency. For instance, chronic disease management systems can help with personalized care plans to minimize unnecessary procedures and optimize treatment options and improvements. These technologies, systems and tools have all demonstrated their impact on improving operational efficiency while yielding improvements in care quality and costs.

In the senior living sector, the most beneficial technologies for operators include AI/predictive analytics, EHRs, Smart Sensors and IoT devices, Automation systems, smart home solutions and telemedicine platforms. These technologies not only improve efficiency and cost, but they also enhance safety and increase the quality of care in senior living facilities. - Workforce Development and Retention: Organizations are creating comprehensive approaches to staffing challenges through multiple initiatives:

- Revenue and Pricing Innovation: Operators are diversifying their revenue streams while carefully balancing affordability with sustainability. Communities that have implemented ancillary service programs are generating additional revenue of $12,000 annually per resident. Leading operators are also shortening sales conversion cycles through targeted marketing automation, streamlined assessment processes, and improved prospect engagement strategies - reducing the average time from inquiry to move-in by 30-40%. Research shows that higher average wages correlate with increased hours worked by nursing staff, suggesting that strategic wage investments can reduce expensive agency staffing while improving care consistency. Regional density and local market specialization are proving particularly effective, with operators focusing on specific market segments that show stronger financial performance.

- Future Industry Transformation

- Enhanced public-private partnerships

- Middle-market financial structures

- Quality-based reimbursement systems

- Value-based care payment models

- State-specific funding mechanisms tailored to local wage requirements

The senior living industry faces fundamental structural changes over the next 5–10 years as wage pressures combine with demographic shifts and regulatory evolution. Three key transformative trends will reshape the industry:

- Market Structure Evolution: The next five years will bring significant consolidation and restructuring across the senior living landscape, driven by escalating wage and operational costs. Small and mid-sized operators, particularly in rural markets where 62% of communities already face high vacancies[3], will likely seek strategic partnerships or acquisitions to achieve the necessary economies of scale. We expect to see the emergence of new operating models that blur traditional industry lines, with innovative providers developing hybrid solutions that combine residential care with home health services. This evolution will also drive clearer market segmentation, with operators focusing on specific demographic segments and price points rather than trying to serve all markets. The integration of senior living into broader healthcare networks will accelerate, creating new partnership opportunities but also raising the bar for operational sophistication and quality metrics.

- Regulatory and Financial Landscape: The industry faces immediate financial pressures with approximately $10 billion in loan maturities coming due in 2025, adding urgency to operational transformation. This challenge coincides with fundamental regulatory changes, including CMS value-based care mandates by 2030. These converging pressures are driving the emergence of new funding models:

- Technology and Care Delivery Transformation: The next generation of senior living technology will move beyond operational efficiency to fundamentally transform care delivery models. We expect integrated platforms that connect everything from resident health monitoring to predictive maintenance, replacing today's point solutions. Artificial intelligence will evolve from basic documentation support to driving care planning decisions and risk management strategies. Blockchain applications for credential verification could reduce hiring time by 30%, while new remote monitoring technologies will enable innovative staffing models that help offset wage pressures. These advances will create clear competitive advantages for organizations that successfully integrate them into their care delivery model.

These changes will fundamentally reshape the senior living landscape, separating organizations that successfully adapt from those that remain wedded to traditional models.

Conclusion

The convergence of rising minimum wages, demographic shifts, and operational pressures is catalyzing unprecedented change in senior living. While wage increases pose significant financial challenges, with labor costs already exceeding 60% of operating expenses in many communities, forward-thinking operators are leveraging this moment to fundamentally transform their business models - implementing technology that simultaneously improves efficiency and care quality, developing innovative staffing models, and creating new service delivery approaches.

As the industry moves toward 2030, success will increasingly depend on operators' ability to achieve scale, embrace technological transformation, and adapt their care models to changing market realities. Those who move decisively now to address these challenges will not only survive in an era of higher wages but will help define the next generation of senior living.

[1] https://digital.ahrq.gov/health-it-costs-and-benefits-database

[2] https://www.chaseclinicaldocumentation.com/the-evolution-of-medical-scribing-from-manual-to-ai-powered

[3] https://www.argentum.org/the-2025-outlook-resilience-recovery-and-the-road-ahead-for-senior-living/

ANKURA – PERFORMANCE IMPROVEMENT EXPERTS, FOCUSED ON YOUR SUCCESS

Ankura’s Performance Improvement team partners with clients to evaluate and identify opportunities to increase revenue and appointments, minimize clinic and shared service costs, and support both patient and employee satisfaction. Fundamentally, we identify avenues to let doctors be doctors while supporting EBITDA goals and business/owner objectives.

We Focus on Key Areas to Support Patient Lifetime Value and Corporate EBITDA

ANKURA PERFORMANCE IMPROVEMENT

Delivering End-to-End Solutions to Companies at Critical Inflection Points

Ankura's Performance Improvement team partners with private equity, lenders, and management to drive rapid EBITDA and cash flow improvement. Using our 3D (Diagnose, Define, Deliver) framework, we assess opportunities, develop sustainable goals and operating plans, and implement solutions.

Our expertise spans diverse industries, including Retail, Direct-to-Consumer, Healthcare, CPG, Services, Education, Manufacturing, and Logistics.

Our experienced operators and consultants address strategic and operational challenges, delivering data-driven, transformative results quickly and efficiently.

Visit Us at: Ankura Performance Improvement

email: performanceimprovement@ankura.com

Sign up to receive all the latest insights from Ankura. Subscribe now

© Copyright 2025. The views expressed herein are those of the author(s) and not necessarily the views of Ankura Consulting Group, LLC., its management, its subsidiaries, its affiliates, or its other professionals. Ankura is not a law firm and cannot provide legal advice.