With the recognition that hybrid virtual and in-person care will be the standard going forward, and that nontraditional players will own as much as 30% of the primary care market by 2030, how can health systems position themselves in this transformation? Storefront healthcare has been around for more than two decades. In that time frame, the speed with which the early Walgreens and CVS clinics have accelerated their capabilities and geographic footprint is remarkable.

So, what type of health system facility strategy makes sense now that patients utilize virtual care for many of their non-acute care needs?

Using AI To Optimize Provider and Facility Utilization

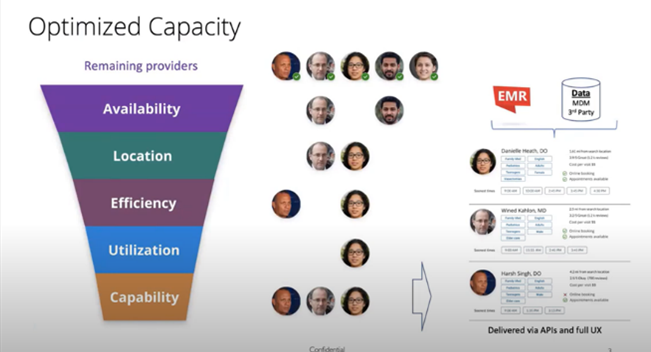

Let us learn from the ways that disruptive technology entities are entering the healthcare space with e-commerce tactics. Dexcare seeks to overcome today’s fragmented consumer experience by navigating patients to healthcare options, appointments, and facilities in a way that automatically allocates those resources when and where they are most productive. Dexcare leverages AI to optimize capacity and balance provider workloads to yield target variables such as shortest visit duration, highest patient satisfaction, and lowest cost of delivery. Key metrics cited by DexCare include a 40% increase in physician capacity through smarter appointment scheduling.

Graphic Source: Screenshots from Youtube Video: Kaiser Permanente and Dexcare

Applying a Capacity Optimization Mindset to Ambulatory Facility Design

If health systems start to think about their small neighborhood clinics through this capacity optimization mindset, we become aware of appointment gaps due to staff needing to take lunch breaks, only one patient being able to use the MRI at a time, and so forth. As the saying goes, “One of anything is a bottleneck.”

These schedule gaps occur because many ambulatory care facilities are designed according to what we call the “McDonald’s model,” nicknamed such because it is similar to the way that Mcdonald's grows - by rolling out small prototype-based facilities in new areas as the population growth warrants additional locations. While Mcdonald's can be convenient, it suffers from the “one of anything is a bottleneck” dilemma. Unlike healthcare, when the ice cream machine goes down, customers are just out of luck.

In contrast, larger facilities that have enough space to house multiple resources gain efficiencies through economies of scale and can unlock value with:

- Supply chain optimization

- Staffing flexibility

- Multiple pieces of equipment that can be shared by multiple providers

- Infrastructure flexibility with multi-purpose functions

- The ability to staff and operate exam room “pods” to match fluctuations in volume

As a thought experiment, what would it look like if an ambulatory care center are designed through the lens of an e-commerce distribution center or a big-box store? Larger facilities have the potential to have a lower cost per square foot due to economies of scale, and the popularity of Ikea and Costco suggests that patients may even be willing to forego aesthetics, translating to lower finish and FF+E costs. Costco and Amazon also rank extremely highly for brand trust, suggesting that their reliability and convenience outweigh their appearance.

Vertical Integration: Alliances With Retail Partners As Part Of A Population Health Strategy

On average, patients interact with healthcare providers four times per year. By comparison, many receive a grocery delivery at home once per week. Hypothetically, if a health system were to partner with Kroger, not only could the EHR function as a repository for food habit data, but the delivery staff member could also be trained to identify opportunities to bring in a healthcare worker to provide preventative care education or escalated resources if a potential health risk is identified. We see early indicators of this tactic with Advocate Health’s partnership with Best Buy and deploying Geek Squad staff into patients’ homes. Patient technology adoption and maintenance is a barrier to delivering healthcare at home and capturing patient data from wearable devices. Advocate’s partnership is very specific in solving this challenge, as the Geek Squad has an established home model, a trusted and recognizable brand, and a broad geographic footprint.

Once patients with chronic or other conditions are identified, they can be directed to a Center of Excellence (COE) as a “one-stop shop” for a multidisciplinary treatment approach. While we have typically seen COEs in high revenue-generating service lines like orthopedics or cancer, opportunities exist to develop these from a chronic disease lens. New entrants in the COE space include behavioral health, birth to age 5, and senior care. Moreover, COEs for chronic disease management can function as a stepping-stone to the full adoption of value-based care.

From a facility standpoint, this idea changes our site selection approach. Locating Centers of Excellence facilities now requires disease prevalence hot-spotting as well as demographic analysis. The design of a Center of Excellence differs from that of a traditional Medical Office Building (MOB) because there are more large conference rooms for collaborative multidisciplinary meetings, larger exam rooms for multiple providers, and large wall-mount monitors for Zooming-in care partners or remote providers. Ultimately, with aspects of care that are more educational than clinical, patients and their providers may all interact remotely as seniors become more facile with Zoom and other technologies. You are more likely to join a COE ‘Zoom room’ than be in a physical COE room.

Applying A Retail Data Approach to Population Health

E-commerce retailers leverage their understanding of consumer behavior, analyzing intent, motivation, and past interactions to deliver proactive recommendations. They can do this because of the frequency of interactions the consumer has with the retailer. (In my household, someone either places or receives an Amazon order nearly every day of the week.)

However, because patients interact with healthcare providers approximately four times per year, providers do not currently have the same opportunity to collect the volume of data needed to deploy AI to generate “nudges” and recommendations. Healthcare is still struggling with info sharing due to different Electronic Medical Records (EMRs), and systems do not talk to each other so the healthcare provider does not know about minor incidences that could be red flags to something more major.

As a first step, if health systems were to adopt some of the behaviors of a retailer, they would text message or email the patient with reminders to get their annual flu shots, physicals, colonoscopies, mammograms, and so forth.

As a long-term play, if health data collected daily by digital devices were linked to the Electronic Health Record (EHR), providers could use it to proactively manage the patient’s care.

What this could look like in the future:

- Providers reaching out to patients about the need for an appointment. For example, tracking the weight of a heart failure patient and seeing notable increases would trigger an immediate appointment request.

- Fewer follow-up appointments. If patient vitals are being tracked daily, we might not need scheduled follow-ups as we do now. With daily data, providers only bring patients in when flags are raised. This maximizes physical space and leverages virtual capacity.

- Rise in “non-traditional” and preventative medicine. For instance, a prescription for healthy food that maybe someday would be subsidized by insurance – sounds a lot cheaper than pills!

- Hopefully, we will see a reduction in controllable conditions and yes, the ability to intervene before someone has a heart attack through better chronic disease management.

- Increase in retail partnerships. Such as with Kroger, Best Buy, or Uber. Let each company focus on its core strengths.

Looking ahead, we foresee the integration of these monitoring apps into the EMR and connectivity with retail behavior, continued on-demand and delivery to the home services, and rapid technological advances. We have made some headway over the last few decades, but the next decade should move even faster than ever now that private equity and for-profit funding are involved.

The technology provider Xealth is making initial steps into this realm. A platform that enables providers to “prescribe” third-party digital apps, educational content, remote patient monitoring, and even meal deliveries directly from the EHR, Xealth subsequently monitors that patient's usage of that app or device.

The brick-and-mortar impacts of a retail data collection approach include reducing the need for physical capacity by leveraging virtual capacity through telemedicine.

Conclusion

It is an exciting time because experts in several different fields are joining together to improve health. Technology, customer service, behavioral economics, and other professionals are leveraging their competencies to make progress toward disease prevention. It might look like a messy start-up enterprise right now, but the possibilities of bringing care to the patient, trimming wasted expenses, and reducing the Capex on physical space offer a very promising outlook.

About the Author

Erin Nelson is a Managing Director in the Ankura Healthcare Real Estate Strategy group. Her recommendations help our clients better serve the needs of their communities, save money through service lines and real estate rationalization, and plan for the emergence of new care delivery models. Erin also leverages predictive analytical models and market analytics to determine space utilization and opportunities for operational improvement. Erin has performed capacity and market analyses for campuses from greenfield micro-hospital sites to multi-campus academic medical centers.

The Ankura Healthcare Real Estate Strategy Group helps healthcare providers manage costs and risks to ensure that their investments realize their financial value to the organization today and decades into the future. We are an experienced team of professionals who create targeted solutions using strategic imperatives and data justification. Our investment scenarios include operational metrics to cultivate leadership consensus around future performance targets and financial viability.

© Copyright 2023. The views expressed herein are those of the author(s) and not necessarily the views of Ankura Consulting Group, LLC., its management, its subsidiaries, its affiliates, or its other professionals. Ankura is not a law firm and cannot provide legal advice.