Healthcare Services Transactions Update — Q1 2025

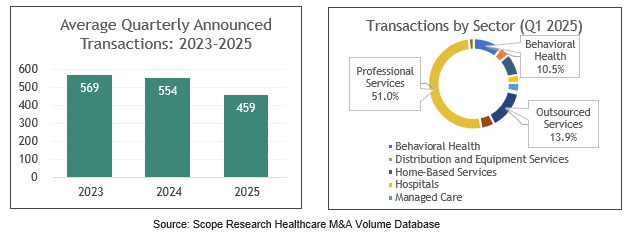

Ankura is pleased to present an overview of healthcare services transactions announced or closed during Q1 2025 in the United States. Total transactions decreased by 15.0% in the first quarter of 2025 after decreasing by 0.9% in the fourth quarter of 2024. Compared to Q1 2024, transaction volumes for Q1 2025 were down by 18.9%.

Notable Transactions Announced or Closed in Q11

- Sycamore Partners entered into a definitive agreement to acquire Walgreens Boot Alliance (NASDAQ: WBA) on March 6, 2025. The proposed purchase would be $11.45 per share, implying a $23.7 billion enterprise value, or a 0.2x price to revenue multiple and a 13.4x price to earnings before interest, taxes, depreciation, and amortization (EBITDA) multiple. WBA provides pharmacy and healthcare services both in the U.S. and internationally.

- Bain Capital announced a proposal to acquire a 60.7% interest in Surgery Partners (NASDAQ: SGRY) on Jan. 27, 2025, for $25.75 per share. The acquisition would give Bain Capital ownership of all SGRY shares, as it currently owns nearly 40.0%. The proposed price implies an enterprise value of $6.3 billion, or a 2.0x price to revenue multiple and a 12.4x price to EBITDA multiple. SGRY owns and operates ambulatory surgery centers and physician practices throughout the U.S.

- McKesson entered into a definitive agreement to acquire an 80.0% interest in Prism Vision on Feb. 5, 2025, for $850 million, implying a 14.2x price to EBITDA multiple. Prism Vision provides ophthalmology and retina management services throughout the U.S.

- New Mountain Capital entered into a definitive agreement on Jan. 14, 2025, to acquire a majority interest in Access Healthcare. The proposed terms indicate an enterprise value of $2.0 billion, or a 20x price to EBITDA multiple. Access Healthcare provides revenue cycle services to healthcare providers in the U.S.

- Court Square Capital and Windrose Health entered into a definitive agreement to acquire Soleo Health for $1.1 billion, implying an 18.3x price to EBITDA multiple. Soleo Health provides infusion therapy and specialty pharmacy services throughout the U.S.

Key Observations

The first quarter of 2025 saw a significant decline in transaction activity for the healthcare services industry. The number of announced transactions represents the lowest level since the third quarter of 2020. While inflation eased during the first quarter relative to recent years, potential buyers continue to deal with higher borrowing costs as the Federal Reserve maintained the target federal funds rate.

Additionally, healthcare investors face significant uncertainty around healthcare-related and broader economic policies under the Trump administration, including:

- The impact of the tariffs proposed by the Trump administration on both healthcare providers and the broader economy remains unclear.

- The Trump administration and Republicans in Congress are attempting to pass tax legislation that would extend many of the tax provisions in the Tax Cuts and Jobs Act passed in 2017, which were beneficial to corporations.

- Within its broader agenda of reducing government spending, the Trump administration has indicated its intention to modify Medicaid coverage and requirements, including potential work requirements for enrollees.

- CMS’s recent rollout of its aggressive strategy to enhance and accelerate Medicare Advantage audits could lead to additional risks related to value-based care transactions.2

- President Trump signed an executive order to reduce drug pricing through the implementation of the Most-Favored-Nation pricing model.

- While the Trump administration was generally expected to reduce regulatory barriers relative to the prior administration, the Federal Trade Commission (FTC) announced in February that the Biden administration’s merger guidelines would remain in place.

While federal regulatory scrutiny remains uncertain, investors continue to monitor state regulations on a case-by-case basis. While some states only require notification to be sent to government authorities, other states require written approval before the transaction can close. These written approvals could significantly extend the time required to close a transaction, creating another barrier for healthcare investors. Furthermore, these requirements are considered by many to target — at least in part — private equity involvement in the healthcare industry.

As shown in the figures below, recent healthcare acquisitions continued to be dominated by three sectors, making up 75.4% of transactions in Q1: Professional Services,3 Outsourced Services,3 and Behavioral Health. The Professional Services sector remained the most active sector in terms of total transactions as a result of continued interest from health systems and private equity buyers alike, accounting for 51.0% of total deal volume.

In the Professional Services sector, the majority of the transaction activity occurred in dentistry, with 87 announced transactions, and physician practices with 89 transactions. While there were eight acquisitions of larger platforms in the quarter, much of this activity in these sectors was driven by existing platforms acquiring smaller add-on groups.

While Behavioral Health transactions have declined since the COVID-19 pandemic, acquisition activity increased by 37.1% over Q4. This growth was primarily driven by acquisitions in the mental health provider space. However, mergers and acquisitions (M&A) levels remain well below the levels reached during and immediately following the COVID-19 pandemic. After the pandemic, transaction activity for Behavioral Health facilities rose sharply as demand for mental health and substance abuse treatment services increased, and transactions in the Behavioral Health sector have not recovered to similar levels.

The Hospitals sector experienced a significant decline in M&A activity, with 13 announced transactions, representing a 50.0% decline relative to Q4. While this significant decline in activity is driven in part due to elevated transaction levels in 2024 as a result of the Steward Health Care bankruptcy, this is the lowest M&A activity seen in the Hospitals sector in the last five years.

Future Outlook

Looking toward the remainder of 2025, healthcare investors will closely monitor the Trump administration’s ability to successfully pass and implement legislation tied to its stated objectives. Many of the proposed healthcare policies could have significant impacts on certain healthcare sectors. For example, if a work requirement for Medicaid coverage is implemented, this could reduce the potential patient population for healthcare businesses that are more dependent on Medicaid patients, such as behavioral health facilities.

Healthcare participants will also look for clarity on the administration’s healthcare initiatives, given the broad nature of some executive orders. For example, U.S. President Donald Trump’s recent executive order directing agencies and pharmaceutical companies to take steps to deliver the most-favored nation drug pricing did not identify the actions to be taken or if specific drugs would be impacted. At the end of Trump’s first term, the Centers for Medicare & Medicaid Services issued a final rule implementing mandatory most-favored-nation pricing specifically for Part B drugs, which are administered in office. While the final rule was rescinded, if the latest executive order similarly reduces pricing for Part B drugs, certain healthcare specialties with significant drug revenue streams — such as oncology and retina specialists — could be significantly impacted.

Transaction activity will also depend on broader economic issues and policies, particularly inflationary pressures, borrowing costs, and introduced tax legislation. While inflation has trended downward since Trump took office, most industry participants are concerned the recent tariff announcements could lead to higher costs in the short-term. Further, the frequent changes to the tariffs have led to uncertainty, which has likely caused some investors to remain on the sidelines. Borrowing costs also remain higher than investors hoped, with the Federal Reserve maintaining rates and communicating a low likelihood that rates will be reduced over the next few months. Finally, Republicans in Congress, supported by the Trump administration, introduced tax legislation that is generally favorable to corporations. To the extent this legislation is passed substantially similar to its current form, this could spur M&A activity.

Beyond economic considerations, investors are also contending with an ever-changing regulatory landscape. While Andrew Ferguson — the Trump administration’s selection to chair the FTC — was expected to be more accepting of M&A activity, the FTC announced in February that the stricter merger guidelines introduced by the Biden administration would remain in place, leaving investors uncertain as to the federal regulatory landscape going forward. Outside the federal regulatory process, certain states continue to introduce or enact legislation to increase regulatory scrutiny. While the requirements vary on a state-by-state basis, these requirements generally present another obstacle that could extend the deal timeline for investors, potentially leading to differing levels of M&A activity between states.

While potential investors still seek clarity around the new M&A environment under the Trump administration and will continue to monitor legislative developments, the regulatory environment, and economic indicators, the Trump administration is generally expected to be more business-friendly. We expect healthcare M&A activity to remain relatively steady for the coming months, with the opportunity for significant growth in activity as the outlook for the healthcare industry and broader economy becomes clearer.

About Ankura Healthcare Transaction Advisory Services

Healthcare transactions are inherently complex. With deep industry experience, Ankura delivers insights to make informed investment decisions in mergers, acquisitions, and partnerships.

Ankura’s Healthcare Transaction Advisory team is deeply rooted in the healthcare sector, leveraging extensive industry knowledge and expertise to anticipate critical financial accounting aspects of transactions while also understanding the operational drivers. This enables us to proactively address critical financial accounting aspects and operational drivers of transactions.

What sets us apart is the collaboration between our financial accounting due diligence experts and Ankura's specialized teams in healthcare valuation, healthcare operations, tax, information technology, commercial strategies, and human capital. This collaboration ensures a seamless, integrated reporting process for you, combining diverse expertise to provide a holistic view of every transaction. Our approach guarantees that you receive nuanced, actionable insights in a unified and strategic manner.

With senior deal professionals engaged in every transaction phase, we provide immediate updates on significant deal factors and a dedicated analysis of any critical issues, ensuring a thorough understanding and resolution of underlying concerns.

Connect with one of our Healthcare Transaction Advisory experts to navigate the complexities of healthcare with confidence. Meet our dedicated professionals at the link below and reach out to us for more information.

Learn more: Healthcare & Life Sciences Transaction and Valuation Advisory - Ankura.com

[1] Sources: Scope Research Healthcare M&A Volume Database, published by Scope Research; Capital IQ

[2] CMS Rolls Out Aggressive Strategy to Enhance and Accelerate Medicare Advantage Audits | CMS

[3] The Professional Services sector includes dentistry, physical therapy, physician practices, urgent care, veterinary, and other clinics. The Outsourced Services sector includes billing, revenue cycle, management services organizations, marketing, staffing, and other services commonly outsourced by medical practices.

Sign up to receive all the latest insights from Ankura. Subscribe now

© Copyright 2025. The views expressed herein are those of the author(s) and not necessarily the views of Ankura Consulting Group, LLC., its management, its subsidiaries, its affiliates, or its other professionals. Ankura is not a law firm and cannot provide legal advice.